How to Create a Project Budget: A Detailed Step-by-Step Guide

Let’s face it – budgeting can be a headache. You need to create a budget that stakeholders approve of while also ensuring that your team has enough resources to see the project through.

The reality is, many teams struggle with budgets. This is particularly true for creative teams who have less experience with financial management. Luckily, we’re here to help.

In this blog, we’ll tell you everything you need to know about project budgets, including why they’re important, how they differ from estimates, and finally, 10 steps for you to follow to budget better.

By the end of this, you should have a few ideas on how to improve upon your skills. Let’s get started!

What is a project budget?

A project budget is a plan outlining the costs required to complete the objectives and deliverables that a project requires. In other words, this is a document that will show the total amount of funding necessary to deliver a project and how you’ll allocate those funds to specific tasks and activities.

Project budgets are typically built during the kickoff or planning phase of a project, although they require constant monitoring as the project progresses. Failure to build a comprehensive budget and adequately track your spending can lead your project to significantly veer off track.

The importance of proper budget management

More often than not, budgets are underestimated. In fact, a study cited by the Project Management Institute found that actual costs were underestimated in 9 out of 10 projects, resulting in cost overrun that can leave clients and stakeholders dissatisfied. Proper budget management can help prevent these sorts of overrun issues from arising.

There are several reasons why you should invest time into budgeting, one of which is that it’s an important part of securing the correct amount of project funding. Creating an estimated budget helps set the client’s expectations in addition to setting a baseline that you can later compare to your actual project spending.

Not only this, but data on your planned vs. actual budget numbers can be extremely informative when planning future projects. If a project ultimately costs drastically more than you initially planned for, you’ll be able to take that into account the next time you budget for another project with a similar scope and objectives.

Related: The Project Management Checklist: 12 Steps to Follow

Project Budget vs. Project Estimate

Project budgets and estimates are two sides of the same coin, although there are some important distinctions between the two.

The main purpose of an estimate is to provide an approximation of the costs necessary to carry out the project. You’d usually present this to the client as the amount that you think the project is going to cost, but since it’s an estimate, those numbers are by no means set in stone.

On the other hand, your budget is the amount you end up spending while conducting the project activities, and ultimately the amount that will be invoiced to the client.

Ideally, your estimate and budget would be the same. However, it’s a big challenge to predict the exact costs of every project activity, which is why there’s often a discrepancy between the two. The goal is to try to have them be as close as possible to best meet client expectations.

Create budgets and estimates with Rodeo Drive

What is included in a project budget?

Because your project budget will describe how funds will be spent over the course of the entire project, it’s likely that your budget will include several different categories of costs.

For example, here are some of the cost categories most commonly used in project management:

- Labor costs: This involves everything related to team compensation, such as salaries, hourly wages, healthcare benefits, and payroll taxes. Many creative agencies adopt a time-based approach to billing clients for their labor costs.

- Transportation costs: If the project requires the team to travel for any reason, transportation costs should be factored into the budget ahead of time.

- Material costs: Project materials can include a range of things, such as software tools, physical equipment, and space rental necessary to deliver the project.

- Professional service costs: This category might include expenses incurred from consulting with an attorney or other third-party firm on issues beyond the project team’s area of expertise.

The categories you include in your budget will vary depending on the project. For example, a team working on a digital marketing campaign might not have any material costs at all. Your budget should include any and all expenses that are relevant to the project.

Popular project budgeting methods

So now that we’ve covered what goes into a project budget, how do you go about making one? Well, there are many different methods you can use to put them together.

Here’s a high-level overview of the 4 most popular options in project management:

- Activity-based budgeting: When budgeters determine the exact budget inputs required to achieve certain targets and plan around those requirements.

- Analogous budgeting: When you reuse a budget framework from a previous project that had similar objectives and scope.

- Bottom-up budgeting: When you total the budget estimates for each lower-level activity involved in a project to get your overall budget.

- Top-down budgeting: When you start with an overall budget number and then determine how it should be distributed to different areas of the project. This is the opposite of bottom-up budgeting.

The method that works best for you will likely depend on your workflows and the size of your team. For example, it might be difficult to take a bottom-up approach for a year-long project with a large project team, as there may be too many lower-level activities to accurately add up.

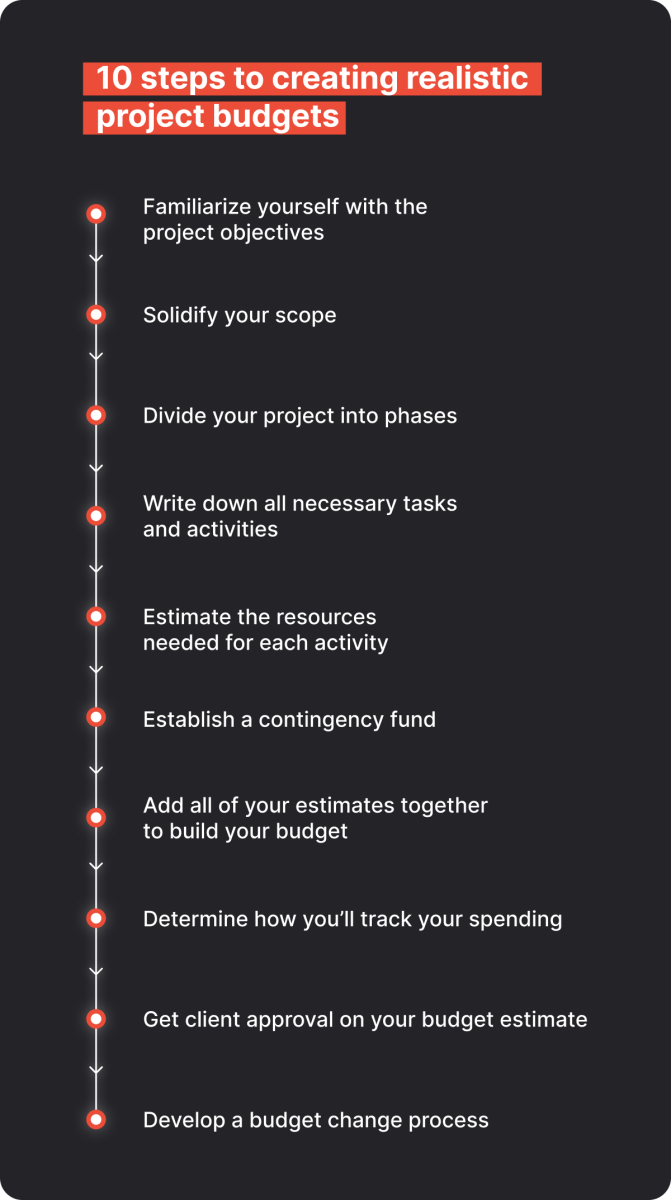

10 steps to creating realistic project budgets

Managing the financial side of projects can be a daunting task – especially for creatives. But like most areas of project management, budgets are easier to tackle when broken down into a series of steps.

Here are 10 steps that we recommend following to create a project budget:

1. Familiarize yourself with the project objectives

First things first: you need to understand what your project entails in order to be able to properly budget for it. Project budgets should be created after you’ve already had an initial meeting with stakeholders and conducted background research – so you should already have some idea of what the project goals are.

For example, maybe your objective is to help your client launch a new product, or perhaps it’s to increase sales of an existing product by a certain percentage. To achieve this goal, you’ll need to produce deliverables, but your first step should be understanding what those objectives are.

2. Solidify your scope

Your project scope is the boundaries of the project – in other words, what’s included in the project and what isn’t. In this step, you should use your scope to nail down your plans for deliverables.

Your deliverables will widely vary by industry but could range anywhere from creating a commercial to developing an integrated marketing campaign to help a client launch a new product.

Understanding your scope is an important part of planning your deliverables because you must consider what the client is looking for. For instance, if the client wants you to create a series of print ads, then having your deliverables be a series of digital ads would be outside of the scope of the project.

From a budget perspective, understanding your scope right from the start prevents overspending, as you’ll embark on the project with a clear picture of what’s worth spending money on and what isn’t.

3. Divide your project into phases

Even when you clearly understand your objectives and deliverables, properly distributing resources can be a challenge. Dividing your project into phases is one of the best ways to make budgeting approachable.

If your project involves filming a commercial, for example, you might find it helpful to divide your project into pre-production, production, and post-production phases. That way you can build three smaller budgets that you can later combine into an overall project budget.

4. Write down all necessary tasks and activities for each phase

The best way to make sure nothing gets forgotten is to write down every single task that’s necessary to complete the project. You can do this by dividing your phases into activities and then adding tasks under each activity.

Let’s say that your project requires you to create a commercial, and one of your activities in the pre-production phase is to create a storyboard. This means you should write down scriptwriting, illustrating, and editing as tasks. This way, you won’t forget to incorporate the time expense that these activities will require into your budget.

Related: Marketing Management Tasks to Prioritize for Successful Results

5. Estimate the resources needed for each activity

If we continue with our previous example of creating a storyboard, the next step is to estimate how much the scriptwriting, illustrating, and editing tasks will cost. Many agencies incorporate tasks into their budget based on the hourly rate of the employee assigned to the task.

So if we expect these three tasks to take 5 hours each, and the writer, illustrator, and editor all have an hourly rate of $65, then we can calculate that these tasks will each cost $325 and incorporate that figure into the budget accordingly.

You’ll then need to repeat this process for every task until each activity and phase has an estimate that appears achievable.

While many of your tasks will likely be time-based expenses, don’t forget to incorporate your flat-rate project expenses into the budget as well. For instance, if you need to rent camera equipment to record the commercial, that expense should be added to the budget under the appropriate phase.

6. Establish a contingency fund

At the end of the day, the budget you create during the planning phase is really just an estimate. There’s no way to be 100% sure how long it will take your team to complete each task, which is why setting aside a small contingency fund can be helpful.

Contingency funds are a small percentage of the project budget – usually, 5-10% – that is set aside to be used when things don’t go according to plan. Things that could warrant dipping into this fund include scope creep or scope changes, an unexpected increase in material costs, or timeline delays that require your team to work more hours than anticipated.

Having this extra padding in your budget helps you better prepare for the unexpected without having to ask the client for more money if a small budget miscalculation occurs.

Even if you don’t end up needing to use this contingency fund, wouldn’t you rather come in under budget instead of over budget?

Related: 8 Tips to Keep Projects Under Budget

7. Add all of your estimates together to build your budget

Once you’ve reached this step, it’s time to add up all of the estimates to create your overall budget. This should include your time-based and flat-fee expense estimates as well as the amount of money you want to dedicate to your contingency fund.

That said, there’s more to building a budget than just totaling up estimations. This step should also include creating a timeline of when you will need each resource to help you better understand when you’ll need to spend the funds.

You should also assign responsibility to a team member for each budget line item. This person will be in charge of ensuring spending on that expense doesn’t get out of hand and that all expenses are properly documented.

8. Determine how you’ll track your spending

A budget is only good if you actually stick to it, which is why tracking your actual vs. budgeted costs is one of the most important steps to follow on this list.

Some teams prefer to manually track their budgets in spreadsheet templates, which require you to constantly check for entry errors. If you’re looking for an easier way to monitor your spending though, you’ll want to invest in a project management software solution.

Related: 12 Best Project Management Budgeting Tools to Try in 2023

Project management tools like Rodeo Drive automatically update your budget as your team records their time worked, which means you can easily visualize how your project spending aligns with your budget without having to fiddle around with spreadsheet formulas.

Project controls are another technique you can use to prevent overspending. Having a team member assume the role of project controller will ensure you have a dedicated person to examine the project data and identify issues that are causing your team to waste funds.

9. Get client approval on your budget estimate

Gaining client approval is almost always the final step to building a budget. You want to make sure that your clients or stakeholders are willing to pay for the project before you begin working on it.

You should go into this step feeling confident in the budget you’ve put together, but also prepared for there to be revisions. You may need to prioritize certain budget items over others, should your client want to cut down on overall spending.

Be sure to paint a clear picture of how each budget activity will impact your ability to deliver on the project objectives. If it’s unclear why a particular expense is necessary, it’s less likely that that expense will get approved.

Related: Pricing Projects Right: 7 Tips From Experts

10. Develop a budget change process

You’ve got budget approval – now what? Well, you should try to stick to that budget as close as you can. But should you need to make changes, you’ll want to have a process in place to get those changes approved.

Such a process can look several different ways. For example, maybe you have team members submit a budget change request on a form before the project manager determines whether the request warrants dipping into the contingency budget or discussing it with stakeholders.

It’s possible that you’ll never need to use this process at all, especially if your scope and schedule don’t change. Regardless though, it’s a good idea to be prepared so you’re not caught off guard.

Project budget example

Above is a simplified example of what a project budget may look like for a project to create a new website when you use a project management software tool like Rodeo Drive.

As you can see, the budget can be broken down into phases, with time activities added under each of them. Tasks handled by a member of the project team will be billed to the client using an hourly rate, whereas items like renting equipment from a third party entail a simple expense.

Create a project budget with Rodeo Drive

In this example, Rodeo Drive automatically calculated the budget of each phase using the hourly rates inputted and adding the cost of all the activities together. The margin indicator will show you if the project is profitable for the company.

Rodeo Drive also allows you to copy your budget framework from a previous project, which can save you loads of time during the set-up process for a new project, particularly for agencies that work on many similar projects.

Create and track project budgets with Rodeo Drive

Now that we’ve shown you what a project budget looks like in Rodeo Drive, it’s only right that we share what else you can do with the platform. Here’s an overview of some of the platform’s other beloved features:

Turn your project budget into a client-ready estimate in one click

Projects begin with a budget in Rodeo Drive, as we believe this is the first step to project profitability. Once you’ve built your budget, you’re able to send it as an estimate for your clients to approve in just one click – sent straight from the platform.

Your estimates are also customizable, meaning you’re free to add your own branding, terms, and conditions, or discounts directly on the estimate before sending it out.

Once the budget is approved, your projects will become “Active” and you can begin working and recording your hours.

Effortlessly track your team’s time

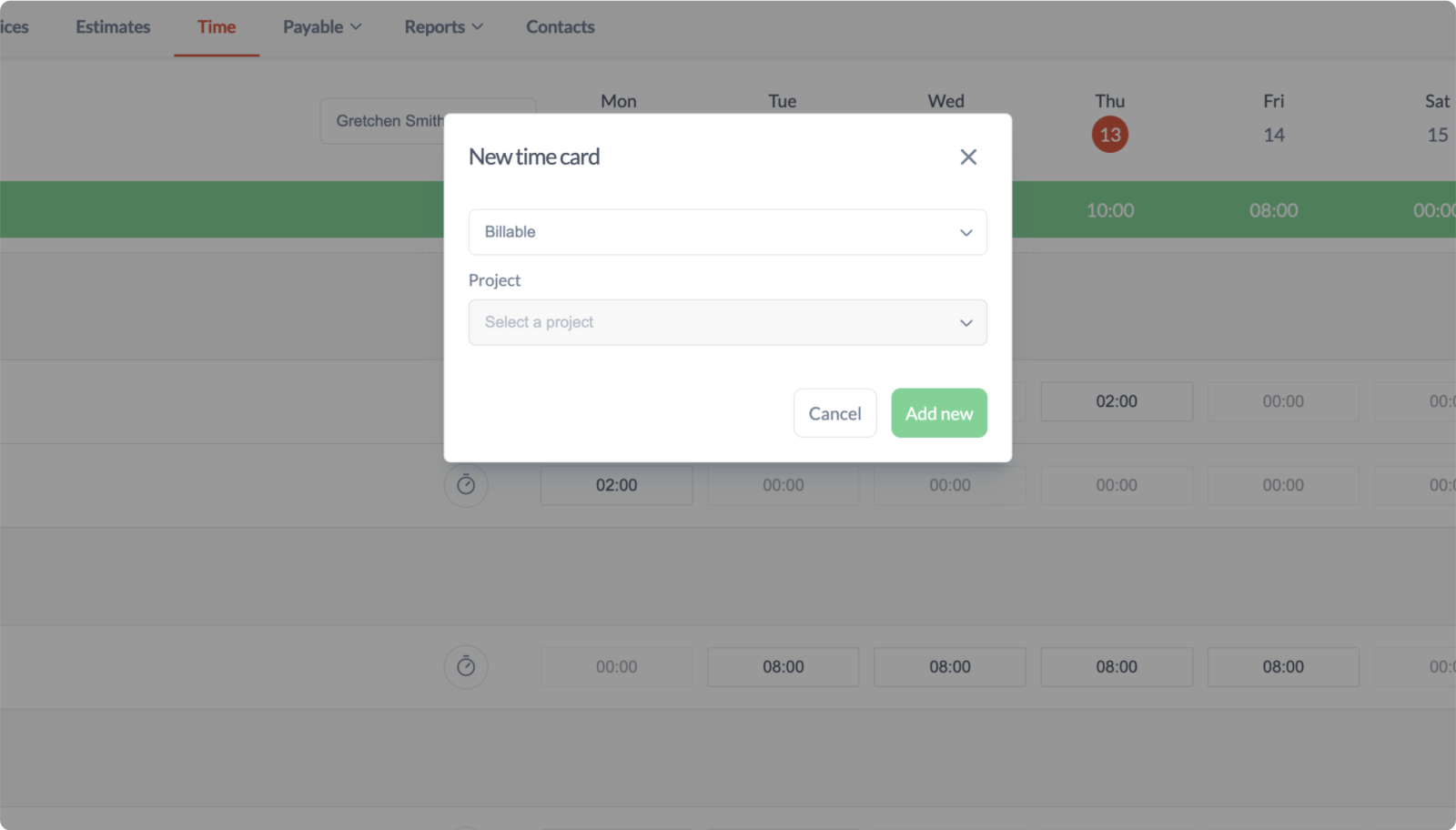

Time tracking can be a hassle, but Rodeo Drive makes it easy by allowing your team to track time in two ways. You can either start the stopwatch on your planner when you begin working on a task or simply add a timecard later.

Every time entry recorded in Rodeo Drive must be connected to a budget activity, meaning your budget will automatically update as you track time. This makes it extremely easy to monitor your team’s spending and ensure your actual costs aren’t more than what you budgeted for.

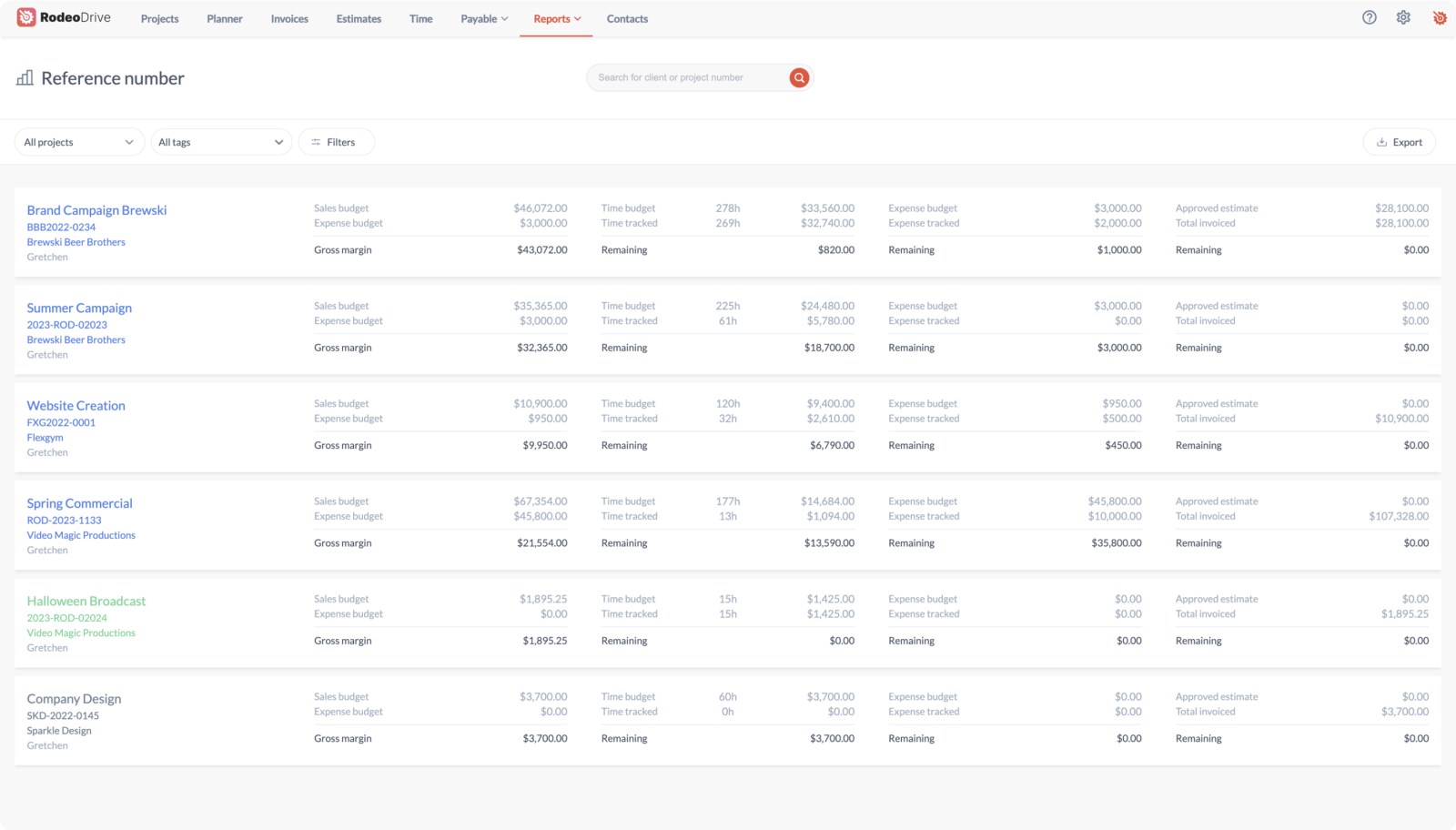

Access reports featuring data-driven insights on profitability and productivity

Reports allow you to monitor progress and help you make data-driven decisions when planning or pivoting, which contributes to project success.

Rodeo Drive’s reporting feature provides detailed reports on time registration, employee productivity, and project profitability. These insights can make workload management easier for future projects.

Additional features:

- Invoicing: Send customizable invoices to clients based on the time you’ve logged in Rodeo Drive.

- Task management: Assign tasks to team members based on their skill level and availability.

- Expense tracking: Eliminate scattered workflows by keeping your expenses and purchase orders all in one place.

- Capacity planning: Avoid overwhelming team members by assigning them work based on what’s already on their plate.

- In-app messenger: Keep in touch with your project team without having to navigate through multiple apps.

- QuickBooks (US) and Xero (UK) integrations: To make your bookkeeping processes easier.

Sign up for free to discover how Rodeo Drive can help you manage your budgets. You don’t even need to enter your credit card to get started.