10 Effective Ways to Handle Outstanding Invoices Like a Pro

So, you’ve done the work and it’s time to be paid, but your clients always seem to take longer than expected to complete their invoices.

Not only is this annoying, but delayed payment can start to mess with your business’s cash flows. Luckily, there are a couple of ways you can mitigate this.

In this blog, we’ll do a deep dive into the different invoice statuses, why it’s important to get paid on time, how you can collect outstanding invoices as fast as possible, and finally — actions you can take when an invoice becomes overdue.

What is an outstanding invoice?

Invoices are essentially a bill for work that’s been completed by your team. Just like the check you receive after a meal at a restaurant, an invoice outlines the specific items or services you received and how much each item costs. In other words, the summary of the commercial transactions between two parties.

Outstanding invoices are invoices that haven’t yet been paid. All invoices will be outstanding at one point, but this isn’t the same as invoices that are overdue or past due, which we’ll explain next.

Are outstanding, past due, and overdue invoices the same?

Although all three of these terms sound similar — and are often used interchangeably — they’re actually not the same thing.

An outstanding invoice is one that’s been sent to the client but hasn’t been paid and the payment deadline has not yet passed. In contrast, a past due invoice is past its due date. All outstanding invoices become past due invoices if they’re not paid by the agreed-upon deadline.

Although past due and overdue invoices can mean the same thing, they often refer to the severity of lateness. For example, “past due” usually refers to invoices that are late by a week or two, but “overdue” might refer to an invoice that’s 30 to 60 days past its deadline.

The importance of getting outstanding invoices paid on time

You might be wondering why staying on top of your outstanding invoices is such a big deal. The main reason has to do with ensuring your business maintains a healthy cash flow.

This is because your unpaid invoices represent money you’re owed for work that you’ve already completed. When your clients don’t pay their invoices on time, your business will have less cash on hand to run its operations with.

For small businesses, this might result in being unable to complete payroll or pay other company bills — both of which can have detrimental consequences for your business’s health.

How to collect outstanding invoices before they become overdue

Past due and overdue invoices tend to bring an onslaught of issues for businesses. That’s why it’s best to make sure you’re paid on time, even though this can be tricky sometimes. The following strategies can help.

1. Always have a contract with clear terms and conditions

Many organizations underestimate the role that customer relationships play in getting your outstanding invoices paid on time. You want to establish a foundation of trust with your clients, and the best way to do so is by starting with a clear contract.

All contracts that you send to clients should clearly outline your terms and conditions for payment as well as the expected cost of your project. This way, there will be no surprises when your client receives the bill.

Also read: Invoicing Clients: 11 Proven Tactics to Help You Get Paid

2. Charge late fees

No one likes late fees, and having them in place might give some clients the incentive to pay on time. There’s a lot of flexibility in terms of how you structure your late fees, as you could charge per day it’s past due or as an entire percentage of the late payment.

You might also be able to use late fees as leverage when convincing a client to pay promptly after they’re already late. For instance, you could offer to waive the late fee in exchange for immediate payment.

3. Consider upfront billing

If you’re concerned about a particular client’s ability to pay — or perhaps you’re just tired of dealing with past due invoices — then requiring payment upfront might be a strategy to consider.

If you require the entire amount to be paid before the project begins, then you won’t have to deal with invoicing altogether. Some clients might be hesitant to pay for work before they see results, which is why organizations with a strong reputation might have better luck with this method.

Alternatively, you could require that the client pay a percentage of the project cost up front as extra assurance that the unpaid invoice will be paid later on. Requiring payment before the project can help mitigate some of the cash flow issues that an overdue invoice might cause.

Related: 10 Best Invoicing Software for Freelancers in 2023

4. Offer early payment discounts

If your business is struggling with cash flow, offering a slight discount in exchange for early payment can be a good technique for speeding up the rate at which your invoices are paid.

This discount doesn’t need to be drastic either. Let’s say your payment terms stipulate that invoices must be paid 30 days after they’re issued, for example. Offering a 3% discount to clients who pay in the first 10 days might be well worth it for a business that needs immediate cash to keep its operations running smoothly.

5. Send reminders as the deadline approaches

Sometimes invoices don’t get paid simply because they got lost in a client’s inbox. Gently reminding clients of their invoice due date far in advance — and reminding them when they’re approaching late fee territory — is a good way to prevent this from happening. Phone calls can serve as a more personalized way to go about this as well.

6. Identify the client’s reason for delaying payment

If you’ve been able to successfully remind the client of their outstanding invoice and they still have yet to pay, then there might be another reason why they haven’t completed the outstanding balance.

Try to drill down on why this might be. Is the client having cash flow problems of their own? Are they dissatisfied with the work your organization completed? This information will help you decide whether to adjust your outstanding payment terms or revisit areas of the project they’re unhappy with.

7. Offer a payment plan

In the event that your client can’t afford to pay the invoice in full, setting up a payment plan ensures that you’ll still be paid for your work. You can create this plan according to whatever makes sense for your business in terms of the amount paid and over what period.

Offering a variety of different payment methods increases the likelihood that your client will be able to quickly resolve any outstanding invoices as well.

8. Halt ongoing work on the client’s account

When dealing with an outstanding invoice for a client who still has an ongoing project with the company, putting a stop to the work you’re doing on their behalf is a good way to create a sense of urgency with regard to the invoice.

A work stoppage might threaten timelines that are important to your client, giving you useful leverage to ensure you’re properly compensated for your work.

How to best handle nonpaying clients

When a client is refusing to complete an overdue invoice, you may end up having to take legal action against them. But before things escalate to that point, here are two strategies you should try:

Send a demand letter

Let’s say the payment deadline has passed, but you still want to recover the payment without completely ruining your relationship with the client by jumping to immediate legal action. Sending a demand letter can be a good first step.

Demand letters typically outline what’s owed and what action will be taken if the invoice isn’t paid by a certain date. Some states require you to have a record of demanding payment before filing a case in small claims court.

Hire a debt collector

Debt collectors are usually a last-resort option. After hiring a debt collection agency, they’ll collect the past due invoice amount from the client on your behalf and take a 25% to 50% cut of the payment amount once it’s been successfully collected.

This is hardly an ideal solution, as you’ll be incurring a loss on a large chunk of the invoice amount. Since this is a last-resort option, it also usually marks the end of your relationship with that client.

When to take legal action

The first thing to do when considering legal action is to conduct a general cost-benefit analysis of the situation. Legal cases can be extremely costly — especially if you need to hire a lawyer.

Is the invoice amount still going to be worth it if you have to pay these fees? For instance, if the invoice amount is $500, it’s more than likely that your lawyer fees (plus the cost of your time) will add up to more than that $500.

That said, you might opt for a lawsuit over a debt collector if you feel as though your case is strong and would prefer to not lose a significant percentage of the invoice amount to a debt collection agency — especially when dealing with a large amount.

Still not sure if it’s the right time to take legal action? It never hurts to consult with an attorney who can give you the right legal advice for your situation. Alternatively, you won’t need a lawyer to resolve the dispute in small claims court.

The best way to manage projects and track invoices

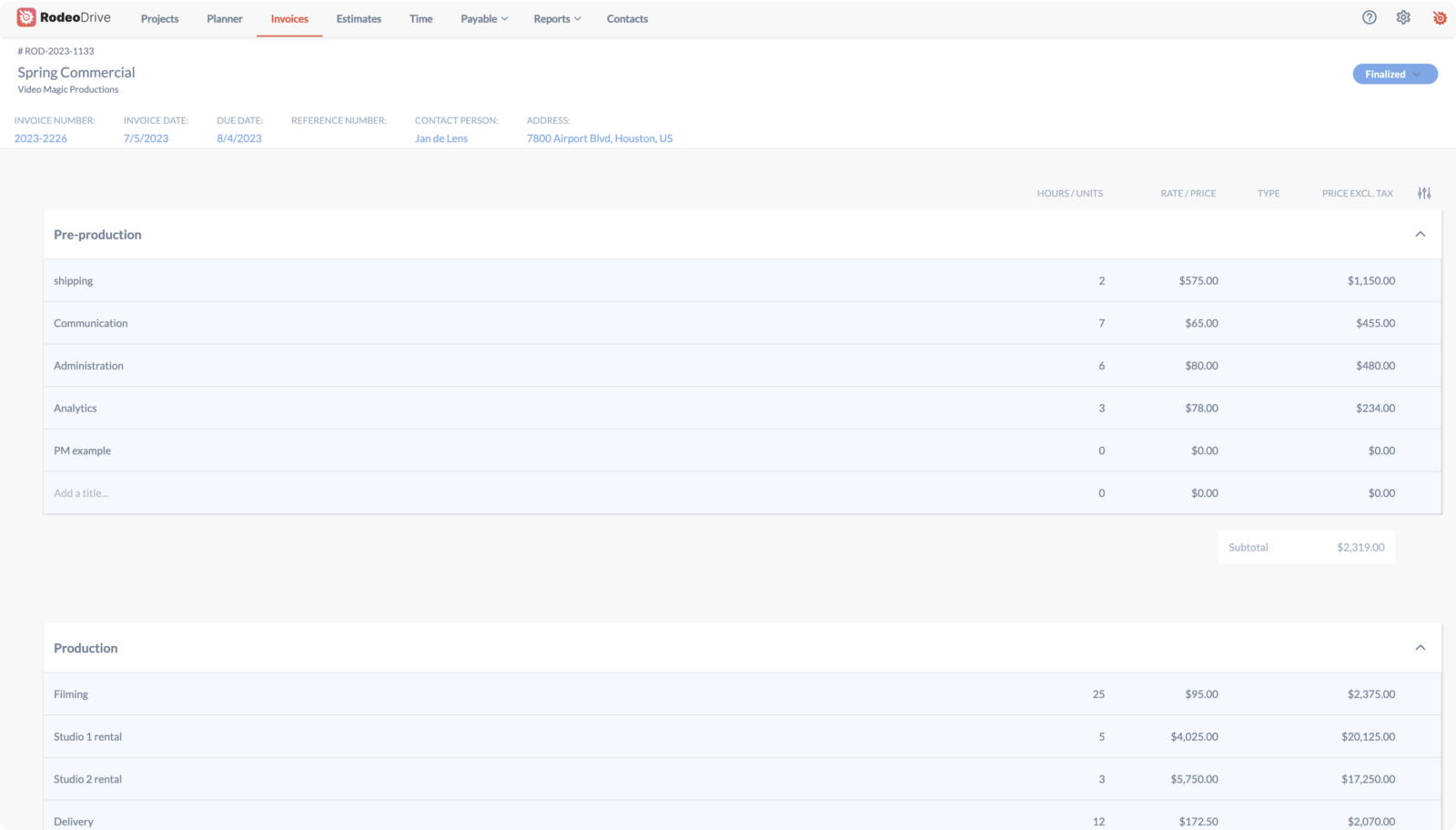

Invoicing without the right software can be a nearly impossible task. That’s why we built Rodeo Drive — a robust project management solution with all of the features you need to build budgets, plan project tasks, track time, and send invoices, all in one place.

Rodeo Drive eliminates the need for creating invoices by hand. Instead, the platform will automatically generate invoices based on the billable hours you’ve logged, which you can send to clients in just a few clicks.

Plus, you’re able to personalize these invoices with your own branding or terms and conditions. Once that's done, send it out directly through the platform (UK) and through QuickBooks integration (US).

The platform also makes it easy to track outstanding invoices by notifying you when they become past due. This way, you can take the appropriate actions to ensure you’re paid as soon as possible.

Rodeo Drive is the best way to streamline your invoicing processes. Come see for yourself and try for free today.