How to Conduct a Cost-Benefit Analysis for Successful Projects

Is this project worth pursuing? As a project leader, you’ve certainly been faced with this question. And while it’s impossible to answer with absolute certainty, there are methods to boost your confidence that a project’s outcomes will make it worth the effort.

One method is a cost-benefit analysis — a business process that factors in the net cost of a project versus the value it will bring to an organization.

Using cost-benefit analysis can add important context as to whether a project should move forward. In this guide, we will discuss what a cost-benefit analysis is, when to use them, and of course, how to perform them.

What is a cost-benefit analysis?

A cost-benefit analysis (CBA) is a systemic way to compare the benefits and drawbacks of a decision. It works by weighing the estimated value of a decision against its estimated costs.

In project management, understanding those relative benefits and costs allows decision-makers to determine if it’s a good choice to pursue a project. If a project’s benefit outweighs its costs — both in monetary terms and in terms of opportunity cost — then starting the proposed project is a good decision. On the other hand, if the costs outweigh the benefits, the project should be reconsidered.

Performing this kind of due diligence before starting a project is an essential part of risk management. It helps organizations avoid infeasible ideas and potential resource waste. A feasibility study is another tool that can help.

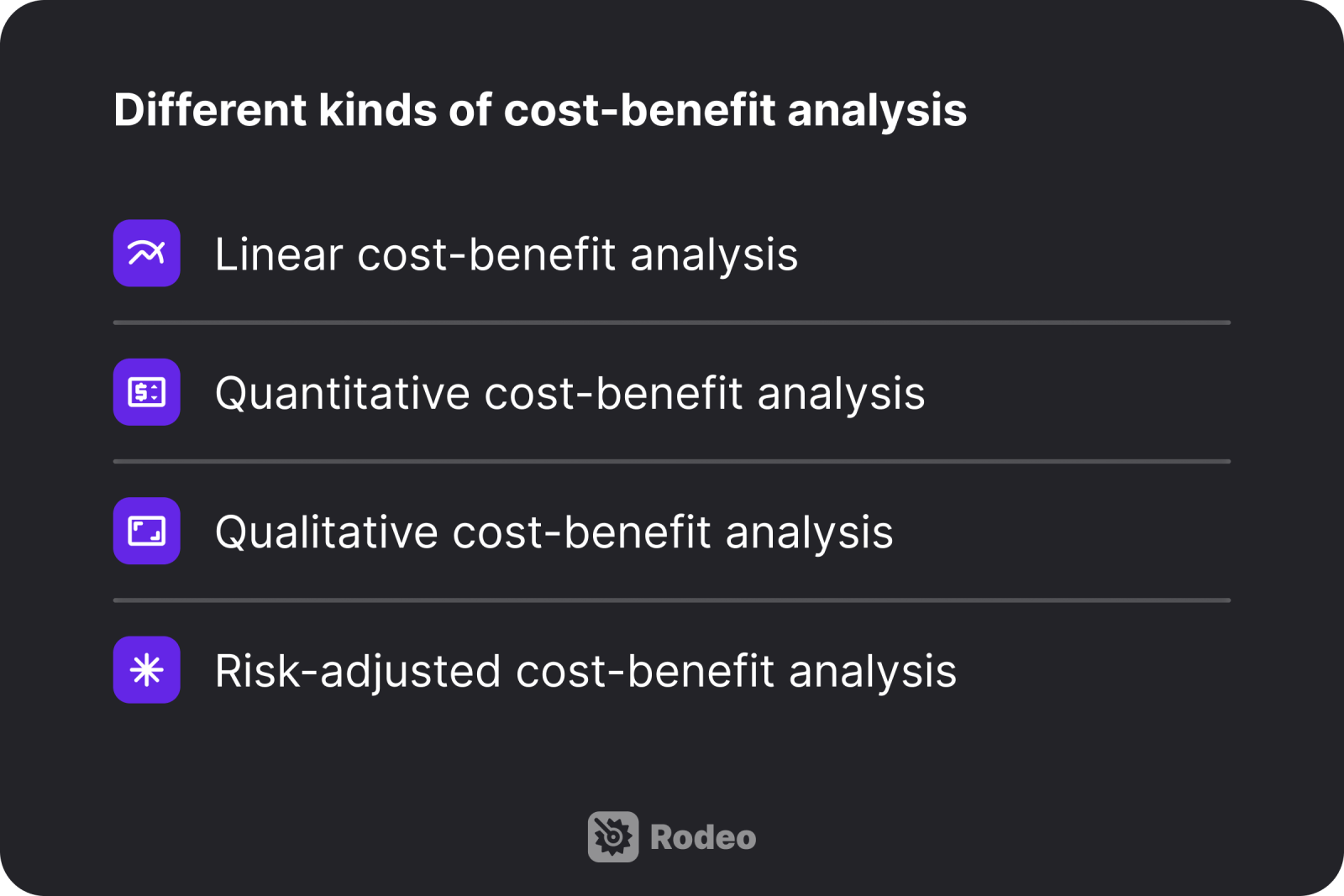

Different kinds of cost-benefit analysis

Depending on a project’s characteristics and scope, different cost-benefit analysis techniques may be more appropriate than others for gathering relevant data points. Let’s cover four cost-benefit analysis techniques.

1. Linear cost-benefit analysis

A linear or simple cost-benefit analysis is the most straightforward. The method entails a direct comparison of the total expected costs to the total expected benefits to determine the net value of a decision. It’s a useful approach for assessing small-scale decisions with limited risk.

2. Quantitative cost-benefit analysis

A quantitative cost-benefit analysis is a more comprehensive version of the simple approach. It involves assigning a monetary value to the expected outcomes of a project. That means building accurate estimates of the future benefits the project aims to achieve.

Decision makers can then weigh the pros and cons of a project decision based on that detailed, quantified data to get a view of the decision’s probable future effects. A quantitative cost-benefit analysis is a rigorous approach that’s useful for decisions that involve large investments of time and money.

3. Qualitative cost-benefit analysis

Sometimes, not all elements of a project are easily quantifiable. While a quantitative cost-benefit analysis focuses on measurable factors, a qualitative analysis addresses the less tangible aspects of a decision, such as employee morale, social responsibility, or customer satisfaction.

Qualitative analysis is used in conjunction with quantitative methods to provide a more holistic, human view of project outcomes.

4. Risk-adjusted cost-benefit analysis

Because future conditions aren’t easily predictable, a risk-adjusted cost-benefit analysis factors in uncertainty.

This method adjusts the estimated costs and net benefits of a project based on the likelihood of various risks materializing, using techniques like sensitivity analysis or Monte Carlo simulations.

Risk-adjusted analysis typically provides a range of outcomes rather than a single expected value, giving a broad picture of the decision’s variability and risk. This kind of analysis is useful for large, complex organizations undertaking projects in uncertain environments.

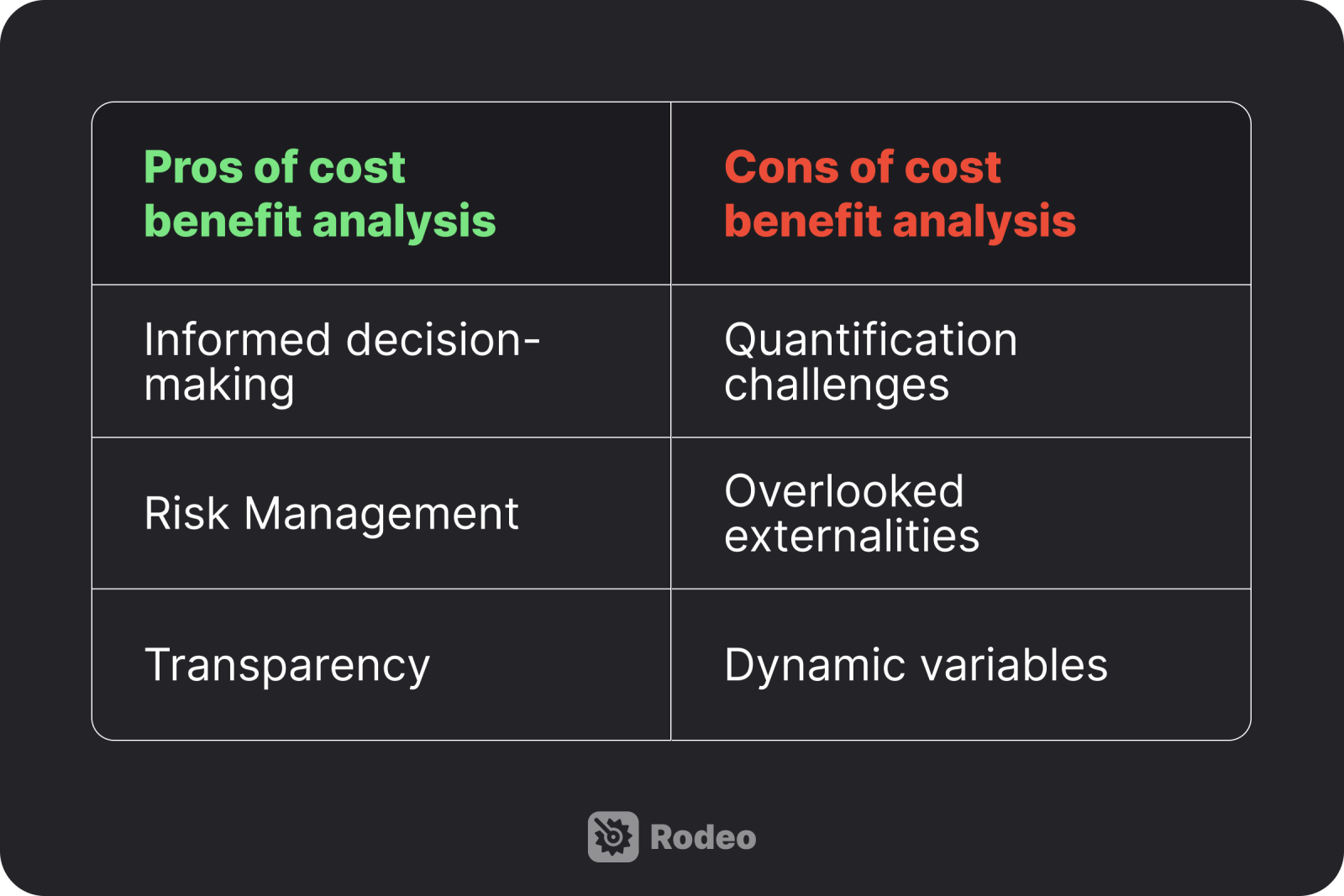

Pros and cons of cost-benefit analysis

While there are plenty of advantages to conducting a cost-benefit analysis, there’s no foolproof method to predict project outcomes. However, here’s a quick list of the pros and cons of performing one:

Pros of cost-benefit analysis

1. Informed decision-making: A cost-benefit analysis provides a data-driven foundation for making decisions, allowing businesses to understand different options based on their potential impact.

2. Risk management: Incorporating risk analysis into cost-benefit analysis allows businesses to identify potential risks and make decisions that minimize these risks.

3. Transparency: The process of conducting a cost-benefit analysis promotes transparency and accountability, as decisions are traceable to clear, verifiable data.

Cons of cost-benefit analysis

1. Quantification challenges: Not all the benefits and costs of a decision can be easily identified. And even when they are, they can be difficult to quantify. Intangible benefits such as brand reputation and employee satisfaction can be difficult to measure with a cost-benefit analysis.

2. Overlooked externalities: A cost-benefit analysis may not always account for all negative externalities, potentially leading to a biased weighing of a project’s true future costs. An externality is an unintended consequence of an economic activity that affects a third party who is not directly involved in the activity, either positively or negatively.

3. Dynamic variables: Changes in the business environment can quickly render a cost-benefit analysis outdated if the assumptions made at the time of the analysis are no longer true.

When should a cost-benefit analysis be used?

While cost-benefit analysis is a versatile technique, you’ll need to understand when using one is most beneficial to make the time you invest in conducting one worthwhile. Here are ideal scenarios where a cost-benefit analysis can yield valuable information insights:

1. New initiatives with assigned monetary value: If you’re undertaking a new initiative with clear a cost structure and precedent for profits, a cost-benefit analysis is an easy way to determine the viability of that new initiative. Client-based projects that all demand similar outputs are a good example of this.

2. Resource allocation decisions: If you need to decide on allocating resources among competing projects, a cost-benefit analysis can determine which allocations will be the most beneficial.

3. Change management: A cost-benefit analysis can be used for due diligence before implementing a policy that will impose a large amount of change throughout your organization.

4. Technology investments: Relevant now more than ever, cost-benefit analyses can help inform decisions on things like bringing on new software. A CBA can be used to quantify the expected improvements in efficiency against costs, allowing for a sound business decision to be made.

Related: Project Cost Management: Everything You Need to Know

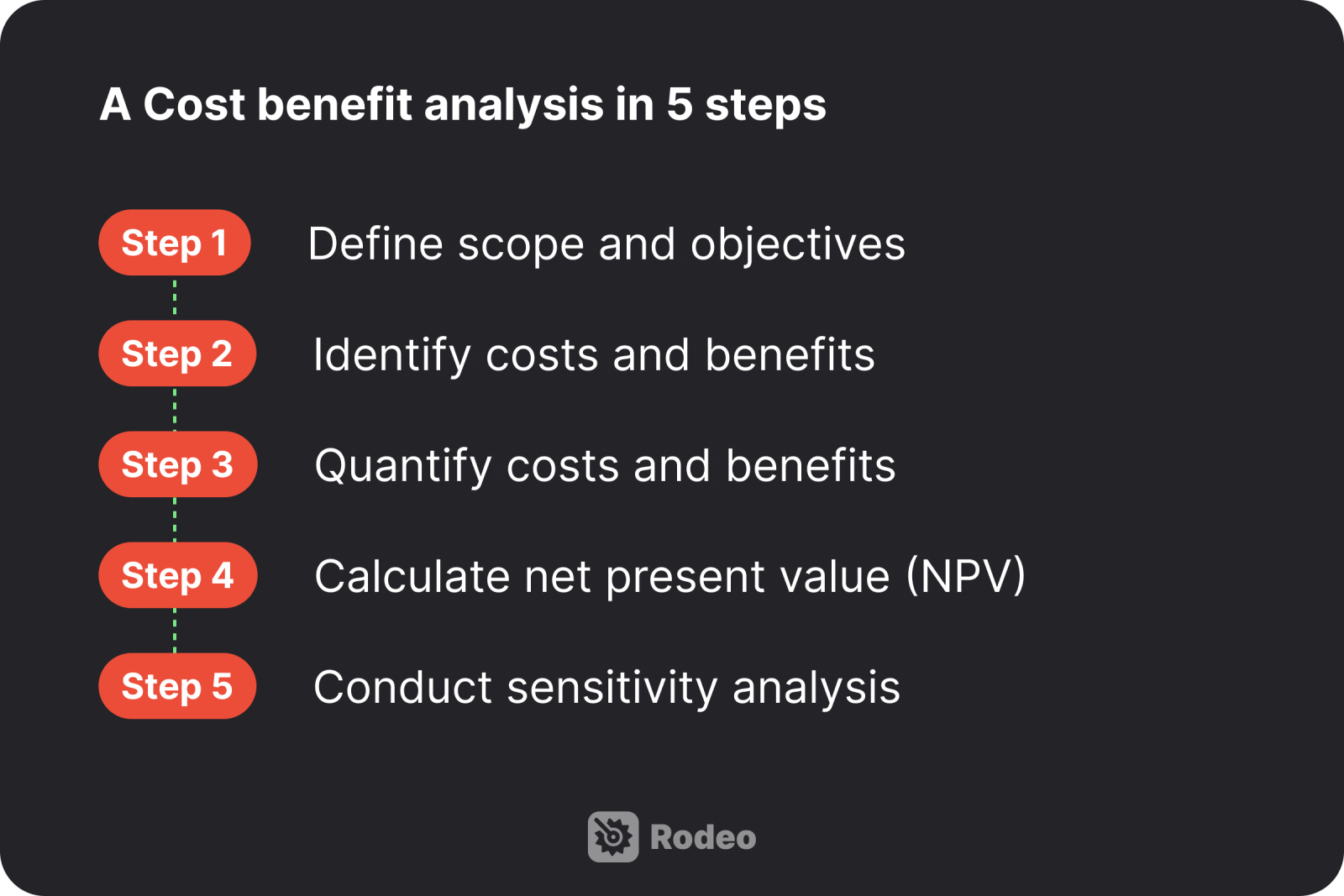

How to run a cost-benefit analysis in 5 steps

Now, let’s walk through what it looks like to perform a cost-benefit analysis, explaining each step in detail before applying it to an example case.

Step 1: Define scope and objectives

Start by reviewing your project plan and clearly defining what aspect of that plan your cost-benefit analysis aims to test. Understand what assumptions in the plan need to be tested, based on the goals and budget of the project.

Step 2: Identify costs and benefits

List all project costs: Include the initial budget of the project, operational costs while the project is running, and possible indirect costs. Remember to consider both one-time and recurring costs. Using a project management tool with budgeting features can make this step a lot easier — Rodeo Drive has intuitive functionality to perform this.

List all benefits of the project: Compile the benefits that will be derived from the project. Look at quantitative measures like profits, but also qualitative measures like innovation, organizational learning, achieving better product-market fit, etc.

Step 3: Quantify costs and benefits

Assign monetary values: Convert all the identified costs and benefits into monetary terms. Use market prices, financial records, or expert estimates to get a clear understanding of these values.

Adjust for time: Apply discounting techniques to account for the time value of money. Measure the cost of time, which can be automated using time-tracking tools.

Step 4: Calculate net present value (NPV)

Perform calculations: With quantitative metrics for the costs and values, you'll want to subtract costs from benefits to get what's called net present value out of the project.

Interpret NPV: Now for the analysis. This can be tricky if there are qualitative factors that must also be considered. Interpret the initial value, consider whether important variables were excluded, and share your interpretation with others in your organization for feedback. Take a second look at qualitative considerations, then decide whether the project should move forward.

Step 5: Conduct sensitivity analysis

Test assumptions: This is an additional step for risky projects where there is an extra need for caution and due diligence. Find out if assumptions hold true when stress tested. Form hypotheticals and look at improbable scenarios to see whether the cost-benefit analysis still returns a net benefit.

Evaluate risks: Manage risks by listing them in a document like a risk register. Come up with contingency plans to prepare for if any of those risks occur.

Cost-benefit analysis example

Building on our understanding of the steps to a cost-benefit analysis, let’s dive into a practical application of the main principles. Consider a large business that’s mulling whether to transition to a new CRM software.

Step 1. Defining the scope and objectives

Reviewing the project plan and scope: Implementing a new CRM across the business.

Cost-benefit analysis objective: The company aims to determine the profitability of adopting a new CRM.

Step 2: Identifying the costs and benefits

List all project costs: Assume the software subscription for the entire organization is ($200,000), customization and integration ($80,000), training for sales and support staff ($40,000), and the potential reduction in productivity during the transition period ($30,000).

List all project benefits: Enhanced customer satisfaction and retention, higher sales efficiency results in a projected 15% rise in sales revenue, and reduced operational costs by streamlining customer service.

Step 3: Quantify costs and benefits

To precisely measure the impact of the new CRM, the company now needs to add the costs together and quantify the relevant benefits.

Here’s the example calculation:

Total costs: $350,000 (including the purchase, customization, training, and transition costs)

Annual benefits: Increased sales revenue estimated at $300,000 per year, operational cost savings of $50,000 per year.

Step 4: Calculate net present value (NPV)

Using the NPV value formula, the company can now assess the financial viability of implementing the new CRM.

You can look at the full NPV formula here, but in simpler terms, it means (Today’s value of expected future cash flows) – (Today’s value of invested cash).

Here are our givens for the example above and the NPV calculation:

Year 0 = $350,000 costs, $0 benefits

Years 1-5 = $200,000 annual subscription, $350,000 annual benefits

The net present value for implementing the CRM system, calculated over five years, would be $299,421. The positive NPV indicates the project is expected to generate more value than it costs, making it a financially viable investment for the company.

After conducting the analysis, the company can move forward with the investment knowing they can expect to both recoup the initial cost of the project while realizing meaningful benefits.

Monitor your costs more efficiently with Rodeo Drive

Now that you know how a cost-benefit analysis works, you’re likely thinking about how to put one into practice. Project management software can make a cost-benefit analysis easier and more accurate.

Rodeo Drive, through a suite of budgeting and reporting tools, centralizes everything related to project costs and cuts down on the hassle of monitoring your project performance data.

Here are some of its useful features for understanding project costs:

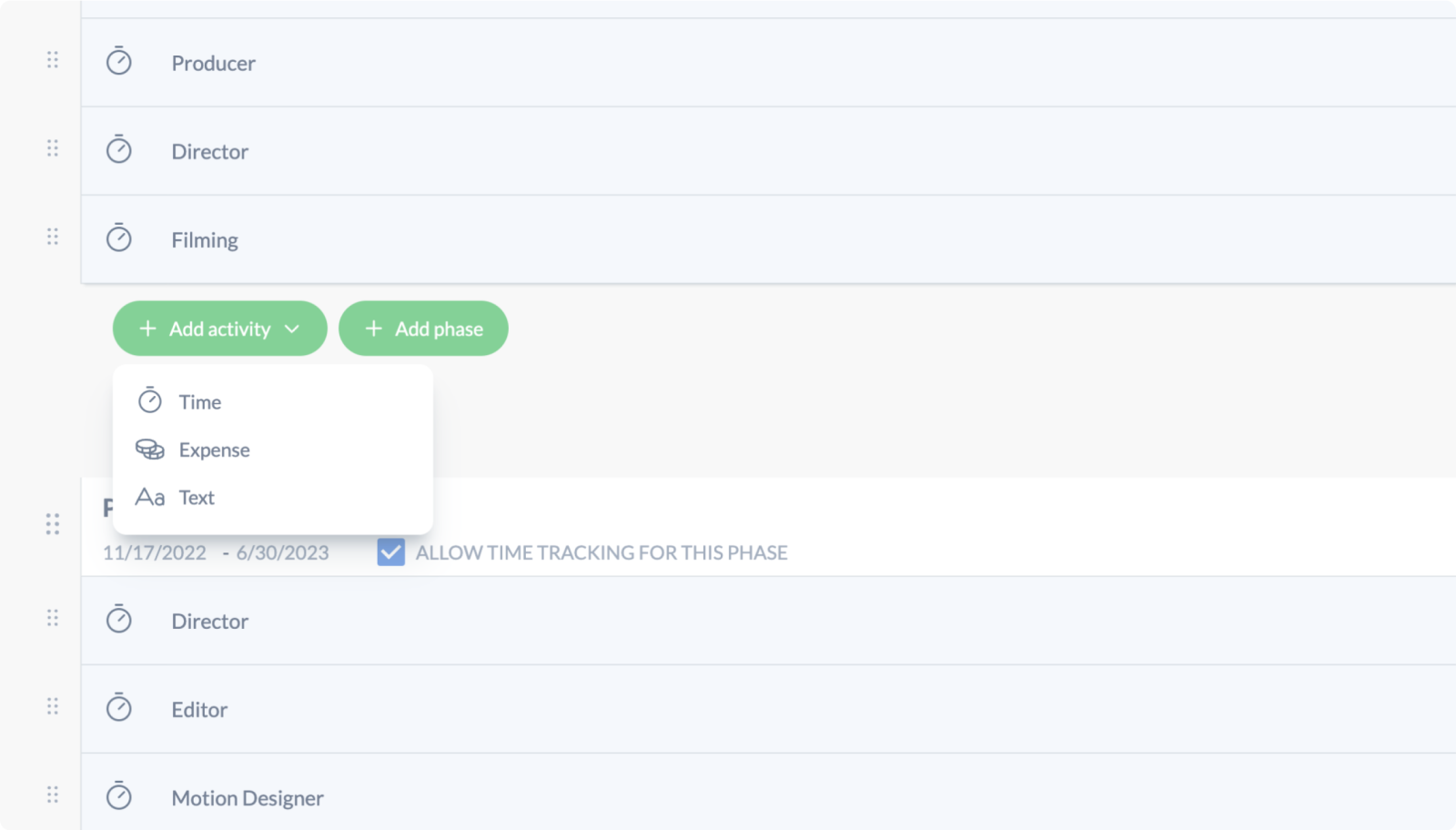

Budgeting

Only 29% of projects finish on time and within budget, often because budget issues aren’t spotted until it's too late. Rodeo Drive tackles this problem head-on by connecting every part of project management with budget tracking.

When you build a budget in Rodeo Drive, you’ll input the time and expense activities you expect to incur at every stage of your project. The platform will then total up all of your expected costs, providing a solid foundation for your cost-benefit analysis.

Easily build budgets by entering your expected time and expense activities

As your team logs their hours, Rodeo Drive will update in real-time to reflect the amount spent on billable project work. This allows project managers to always stay aware of how much budget has been spent throughout all of their ongoing projects.

Receive real-time updates on budget actuals as team members record their time

Additionally, the platform makes it easy to create detailed, client-ready invoices in seconds. These invoices can be automatically generated based on the initial budget or actuals if the project incurs higher costs than estimated. This gives you the ability to manage project profitability and stay well above your bottom line.

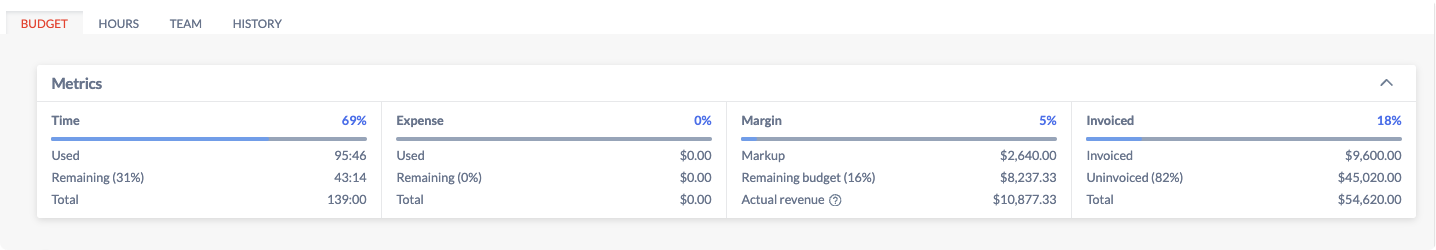

Reporting

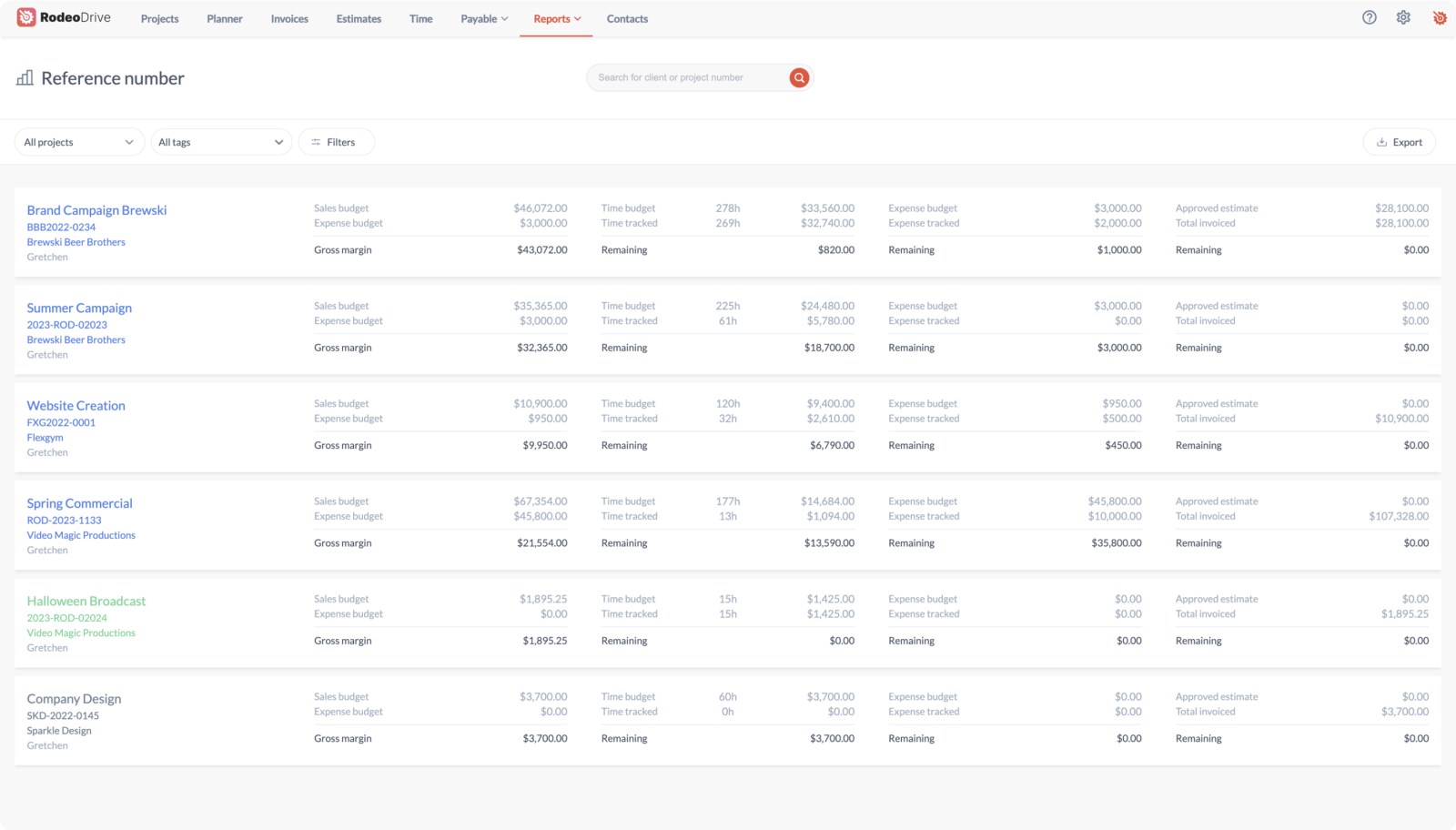

In Rodeo Drive, you can gain valuable insights into your team’s progress and project financials with detailed reporting on projects, productivity, and time.

The Projects report gives project managers a 360-degree view of profitability throughout their entire project portfolio. It offers an up-to-date view of project expenses, gross margins, and time expenditures.

This empowers project teams to easily adjust projects based on current data, allowing for a proactive approach to financial management.

Monitor your margins and stay profitable with Rodeo Drive

The Productivity and Time reports, on the other hand, provide important insights into the cost of time.

Project managers can use them to understand where team members are allocating their hours, which activities are overrunning their budgeted time, and how much individual activities cost given the time they consume.

.png)

Keep tabs on how your team members are allocating time toward projects

This not only allows for more accurate pricing in future projects — it also gives project managers the ability to change current time allocations to achieve greater efficiency.

The best part is you can use Rodeo Drive for free — no credit card needed. Some teams have even used it to achieve 30% greater project profitability. There’s no reason you can’t be next.