Proper budgeting is absolutely essential in ensuring not only a project’s success but also better margins. Without a well-researched budget estimate, it’s impossible to know if you’re properly allocating resources.

While investing in a project management software tool is the best way to manage your project finances and resources, using spreadsheets to track project budgets is a popular second option.

Properly formatted spreadsheets can help teams keep track of their planned versus actual spending in order to identify over expenditures as soon as possible. But, starting a spreadsheet from scratch is often frustrating.

Every industry and project has different budgeting needs, so we’ve compiled a dozen ready-to-use Google Sheets templates to get you started. We’ll also provide you with an overview of the most popular budget methods at your disposal along with templates that fit each one.

12 Ready-to-Use Project Budget Templates

Your budget should include all financial information for your project, so instead of wasting valuable time manually totaling up your expenses, spreadsheet formulas can do all of the calculations for you.

Download the budget spreadsheet template below that best suits your needs and try it out for yourself.

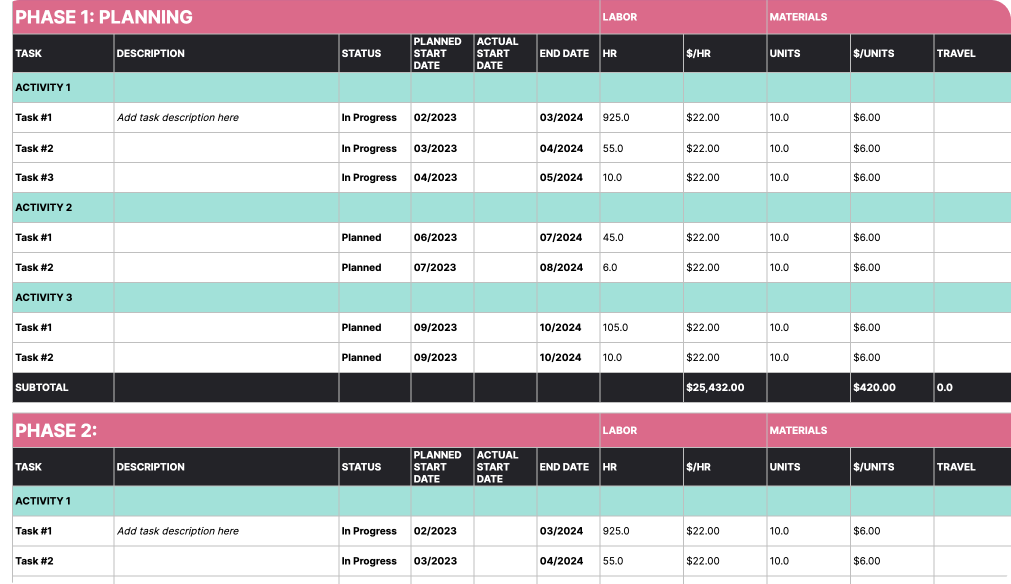

Project managers

Project management involves working on a strict timeline to achieve certain objectives. In order to have project deliverables completed when stakeholders expect them, allocating resources correctly is an important task for project managers.

The first step in doing this successfully is by creating a budget. The below project management budget template adopts a phase-based approach that can help a project manager stay on top of spending at every stage, from planning to delivery. This template can also be used by the director of a project management office:

Click here for a project management budgeting template

Also read: The Project Management Checklist: 12 Steps to Follow

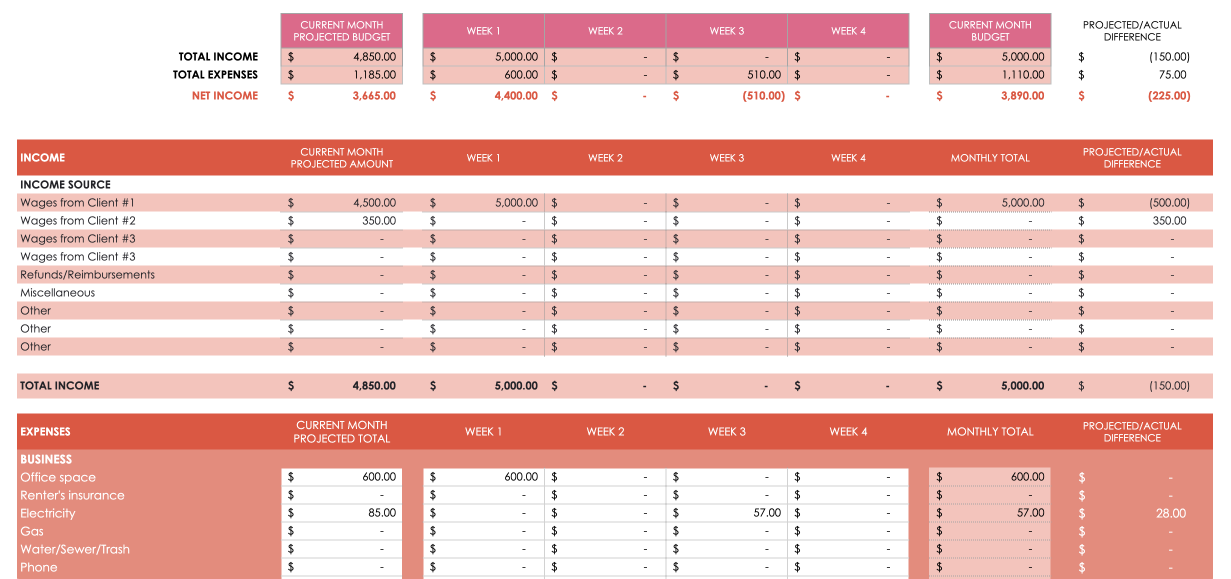

Freelancers

Freelancers have the difficult task of managing their own finances, pricing their projects correctly, and delivering work to clients on time. And with several different clients and ongoing projects going on simultaneously – a project budget spreadsheet template can be a lifesaver.

Use this template to keep track of your income and expenses on a week-by-week basis to ensure your current workload adequately covers your costs.

Click here for a weekly budgeting template for freelancers

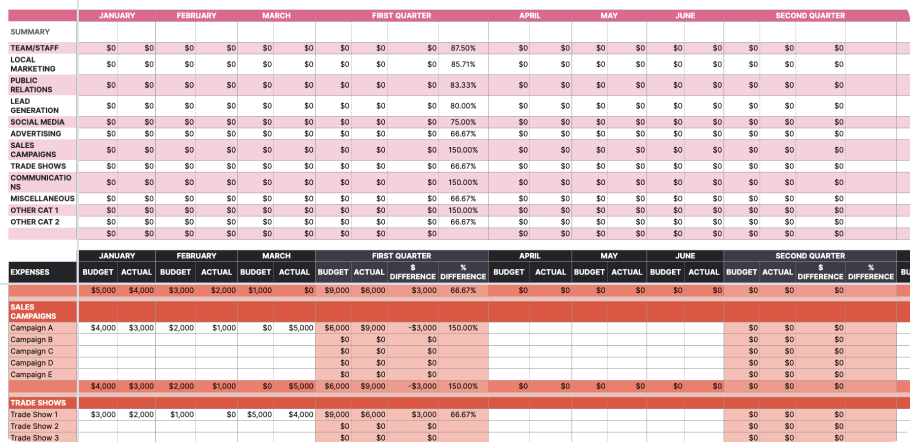

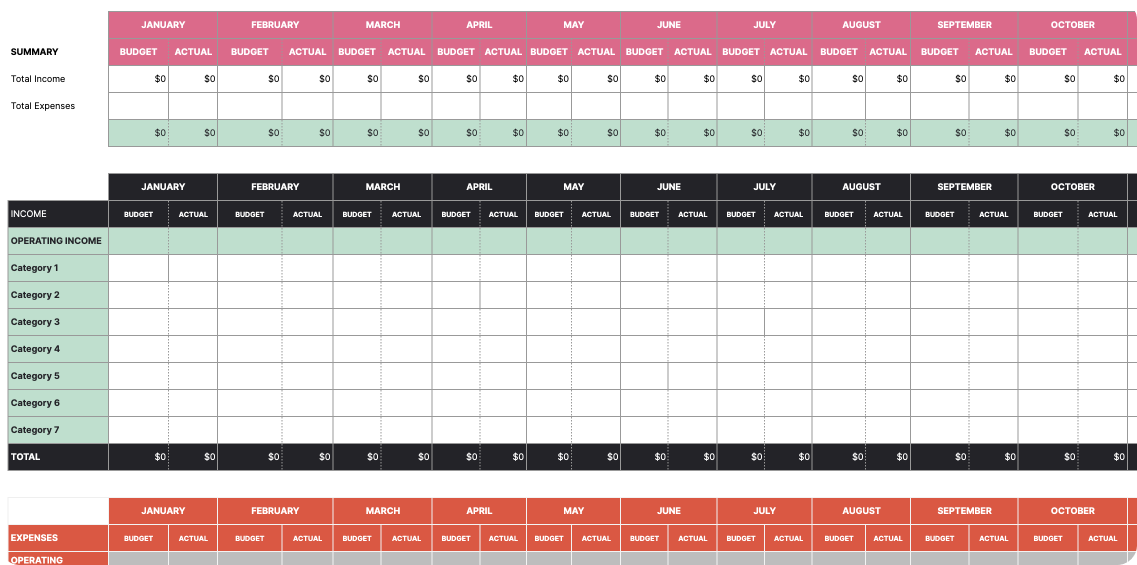

Marketers

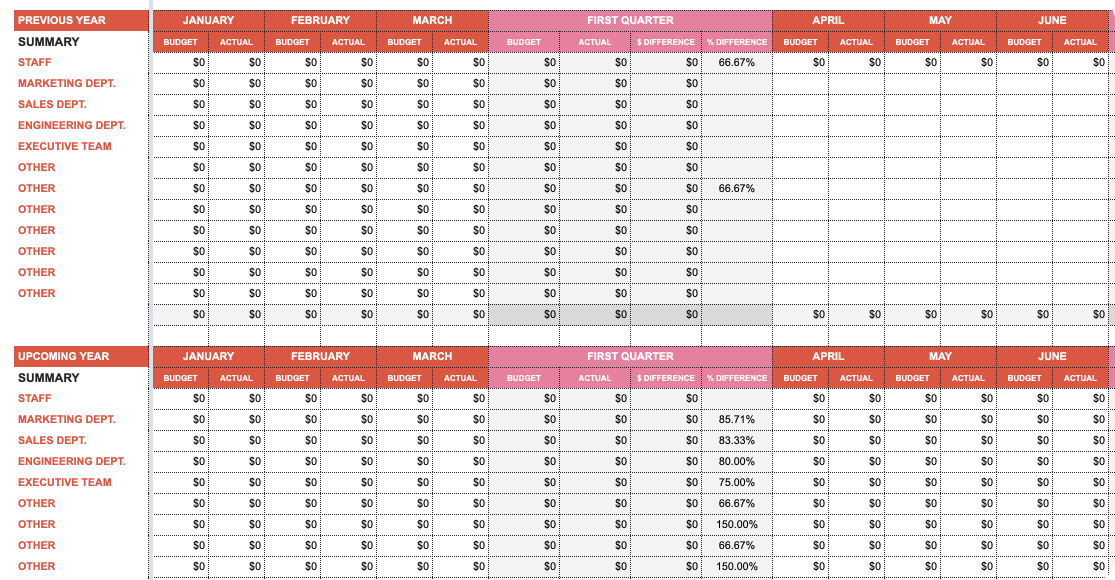

Marketers today are juggling an array of marketing channels, from social media, to print advertising, to online campaigns. Without project management software with budgeting capabilities, it can be difficult to keep track of campaigns and quarter budgets, including how much you’ve spent versus how much you budgeted for.

This free budget template provides you with monthly and quarterly breakdowns on each dollar you’re spending and a high-level summary of your activity totals. Plus, you can see the percentage difference between your budget and actual costs at a glance.

Click here for an annual budget template for marketing

Related: Project Cost Management: Everything You Need to Know

Architecture firms

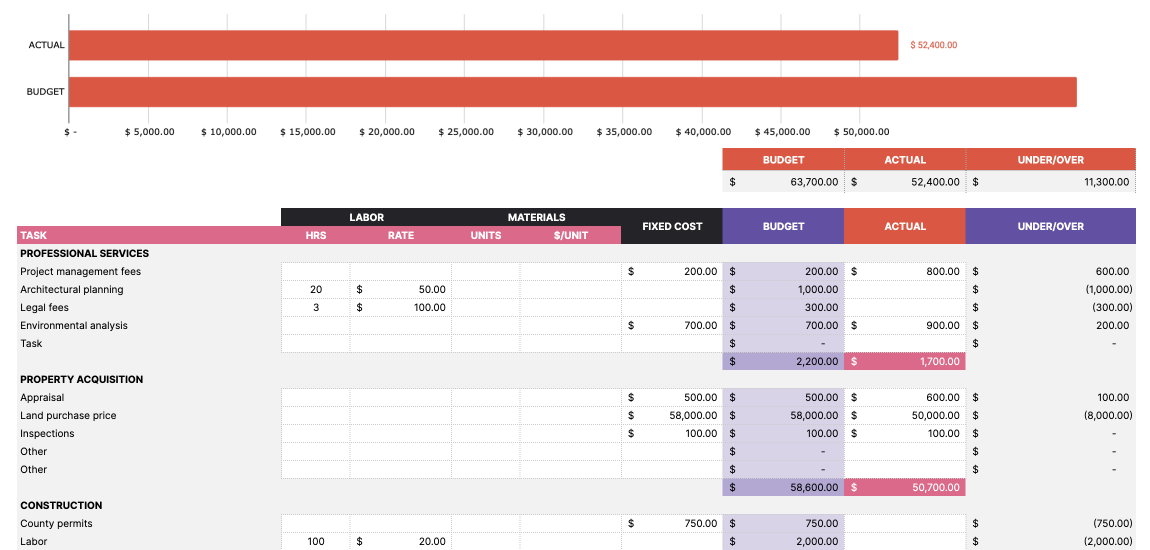

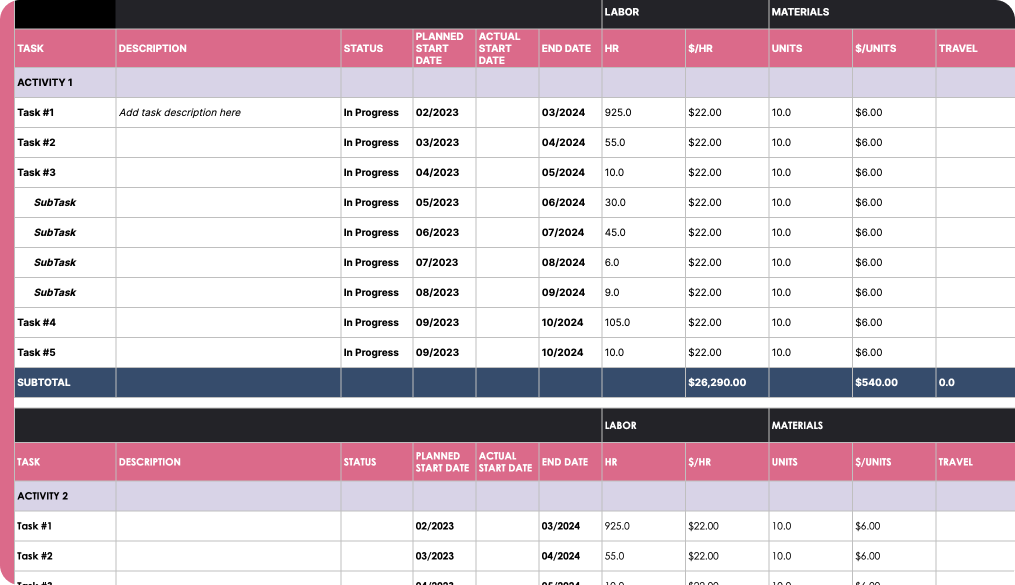

Architecture projects have several moving pieces to keep track of, including creating detailed designs and – in some cases – overseeing the construction process.

Because architecture firms frequently create project proposals and estimate costs, managing the financial side of projects is critical. This simple project budget template is broken down by activity group and includes a horizontal bar graph comparing actual spending to budgeted spending.

This helps architects adequately manage project expenses and strike a profitable balance between labor costs, material costs, and other fixed costs.

Click here for a budget tracking template for architecture firms

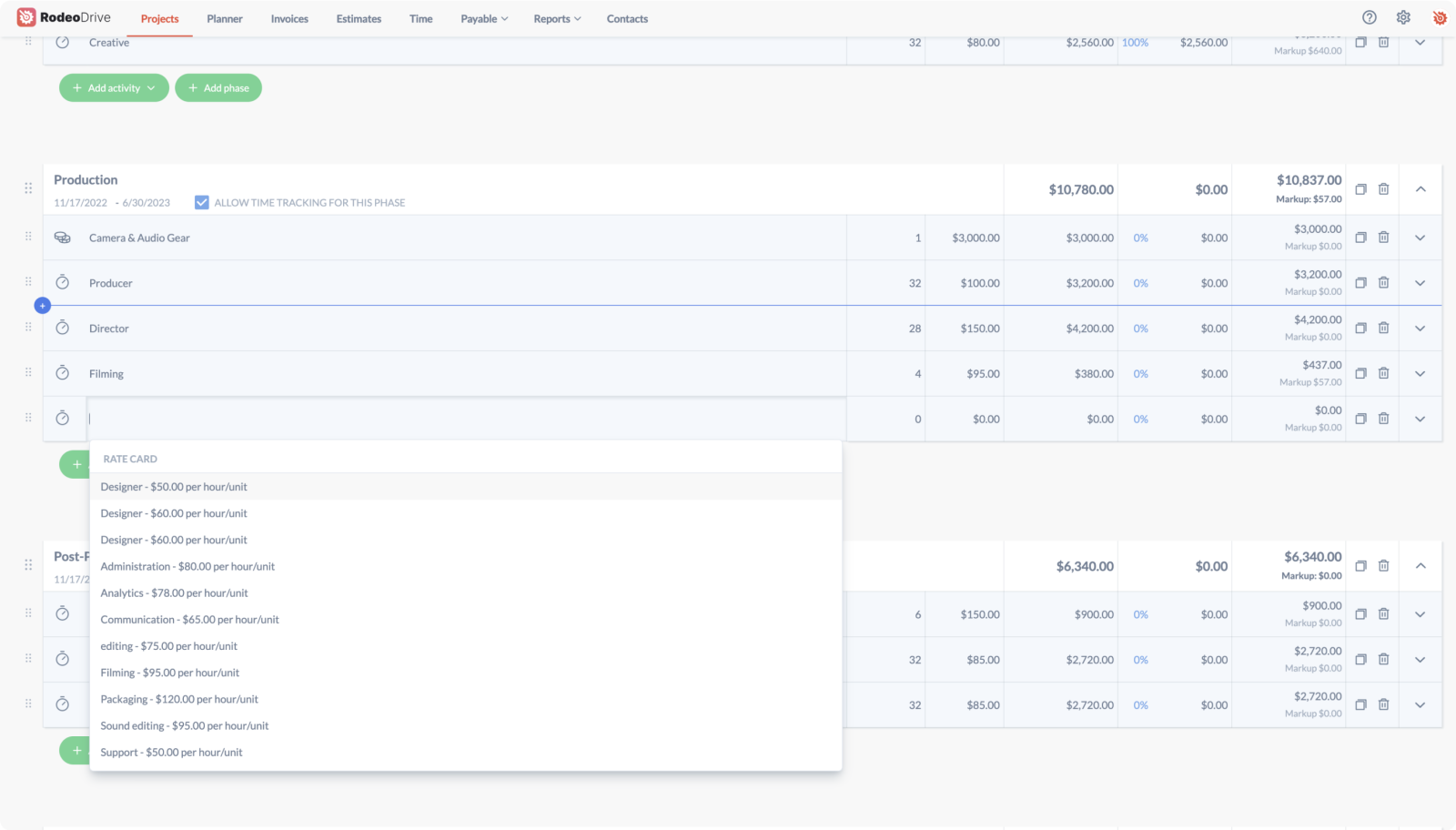

Video production studios

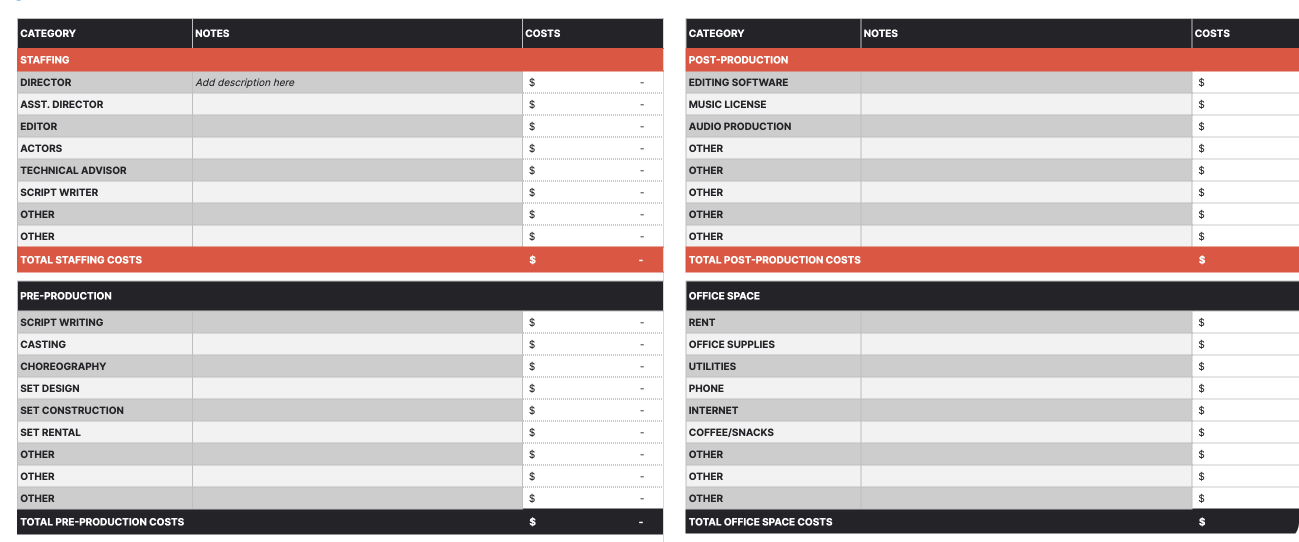

Video production tends to be structured in phases, such as pre-production and post-production. Because of this, production studios may find it easier to structure budget estimates by phase, since this structure allows them to easily understand how much each step of the project will cost.

The below project budgeting template allows you to customize each category of your budget estimate and include descriptions for each line item.

Click here for a budget breakdown estimate template for video production studios

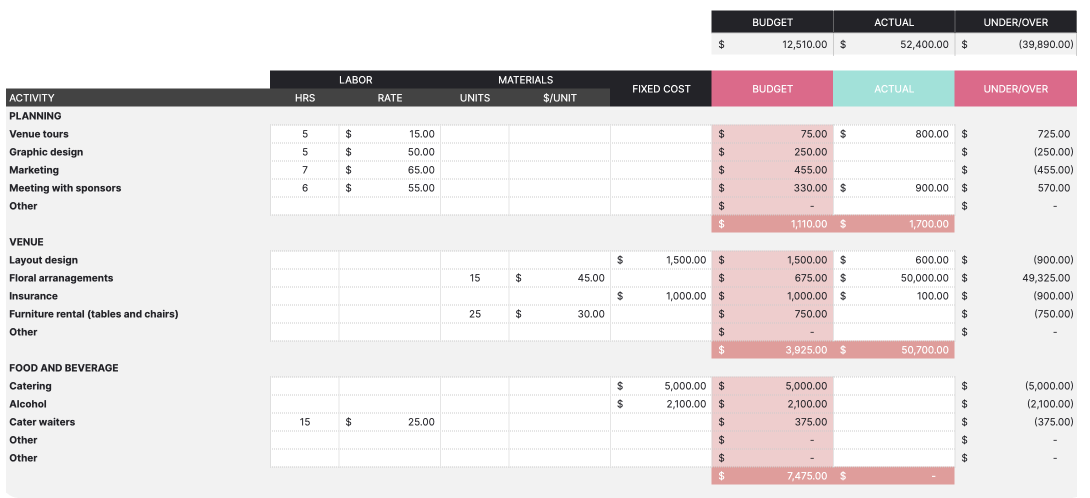

Event management

Event organizers are in charge of not only planning events but also ensuring they run smoothly. As such, event planners must keep a close eye on finances in order to maximize profits and not exceed the estimate provided to the client or other stakeholders.

This template clearly outlines your budget, actuals, and the amount you’re over or under by so that you can quickly make adjustments should a discrepancy arise between the two.

Click here for an event management budgeting template

Related: 8 Tips to Keep Projects Under Budget

Most popular project budgeting methods

The following budgeting methods can be applied to a variety of circumstances, as companies that build annual budgets as well as those building budgets on a per-project basis will find them useful.

Here’s an overview of 6 of the most popular budgeting techniques along with a Google Sheets project budget template for each that you can customize to meet your needs.

Analogous budgeting

Analogous budgeting involves utilizing a budget framework from a previous project with similar objectives and scope and applying that framework to your project.

Reusing the same budget saves time during the project planning stage, as making the necessary changes to the project’s timeline or scope is far less intensive than building a budget from scratch.

This method is particularly useful for companies that work on a project basis and need to provide clients with fast and accurate cost estimates, or those whose projects are very similar from one to the next.

Click here for a customizable template to use for analogous budgeting

Incremental budgeting

Incremental budgeting is an extremely popular technique wherein you take last year’s budget figures and add or subtract a certain percentage in order to obtain the new budget.

The simplicity and ease of use of incremental budgeting make it one of the most common techniques around. However, it’s typically used in business environments where innovation isn’t a top priority, since budgets aren’t adjusting for shifts in company goals.

One main critique of this method is that it can sometimes promote unnecessary spending because if you know your budget will grow by a certain percentage annually, you’re not going to be motivated to cut costs.

Click here for an incremental budgeting template

Activity-based budgeting

Activity-based budgeting takes a top-down approach by requiring budgeters to determine the exact budget inputs required to achieve certain targets and plan around those requirements.

This type of budgeting is extremely forward-looking and goal-oriented, although some critique this method for causing short-term thinking and making it easy to lose sight of long-term goals.

Additionally, the activity-based method requires budgeters to invest time into analyzing what inputs are necessary to create results, which can be cumbersome.

Click here for an activity-based budgeting template

Zero-based budgeting

Zero-based budgets are built from scratch, meaning they do not rely on frameworks from previous fiscal periods. This method gets its name because it assumes that each department begins with a budget of $0 and must start fresh at the beginning of each fiscal year.

So while many companies will reuse the same budget year after year and simply add a percentage to account for inflation, the zero-based method calls for budgeters to start from square one every time.

This is a great technique for identifying what expenses are absolutely crucial and getting rid of those that are unnecessary – which is particularly useful for companies focused on innovation and efficiency.

On the other hand, this strategy can be time-consuming, as budgeters have to decide where to spend every single dollar. And since zero-based budgeting prioritizes cutting costs, it can sometimes reward short-term expenditures over activities that are considered necessary long-term investments, such as research and development.

Click here for a zero-based budgeting template

Bottom-up budgeting

In project management, bottom-up budgeting is essentially totaling up the budget estimates for each lower-level activity involved in a project. The idea is that the sum of all of the activities will result in an estimate of the total cost of the project. This can be done by estimating resources, time, or costs, but typically, cost estimates are built on time estimates.

This technique often works best when the team members responsible for each activity are the ones who estimate the cost of that part of the work, since they likely have a better idea of the resources and time needed to complete it.

Related: 12 Ways to Improve Team Accountability [Remote & Onsite]

Errors may be less prevalent among budgets created using this technique since they should balance out. In other words, if one activity is over budget and another is under budget, the project’s overall budget baseline isn’t impacted.

In general, though, the bottom-up technique is known for giving individuals lower in the company more say in how resources are allocated. For example, department managers can present their needs and goals to the company executives to determine how the budget is created. This method is more time intensive, but it can significantly help ensure people at all leadership levels are on the same page.

This bottom-up budgeting template features sections for each department – or project phase – with activities listed for each, as well as how much each activity will cost.

Click here for a bottom-up budgeting template

Top-down budgeting

As you might guess, top-down budgeting is the opposite of bottom-up budgeting. In the top-down method, company executives determine the budget based on company objectives, which is then relayed to lower-level managers and team members.

This method can be much faster than bottom-up budgeting since you don’t need to estimate the resources required for each granular project activity. That said, it’s also less likely to be an accurate estimation. Senior management typically looks at how the previous year’s budget was utilized as a guide to building the new budget.

Related: A Guide to Project Communication Management

In the following project budget template, department budgets are generally estimated rather than based on specific activities or objectives.

Click here for a top-down budgeting template

Create and manage project budgets easily with Rodeo Drive

Project management templates are helpful in overseeing project budgets, but they still require you to invest time into getting them set up correctly, and you still run the risk of accidentally deleting data or making an error in your code that throws off all of your budget calculations.

If you’re tired of relying on templates to manage your project costs, it might be time to look into a project budget management software.

Meet Rodeo Drive: your one-stop shop for all things project management, including budgeting, time tracking, estimates, and invoices.

Budgets are so easy to build in Rodeo Drive that even the least tech-savvy people won’t face any issues. Each budget is broken down into phases and activities, under which users can add time activities and expenses.

If a task takes twice as long as you budgeted for – no worries. Because Rodeo Drive is an all-in-one tool, every feature is connected. Rodeo Drive allows project managers to easily keep tabs on their labor costs and the status of project tasks.

This means that in each instance where time is tracked, your budget will update in real-time, so you’ll know immediately if your project is over budget and you can adjust accordingly. This is very different than spreadsheet templates that require you to manually input every hour a team member logs on a task.

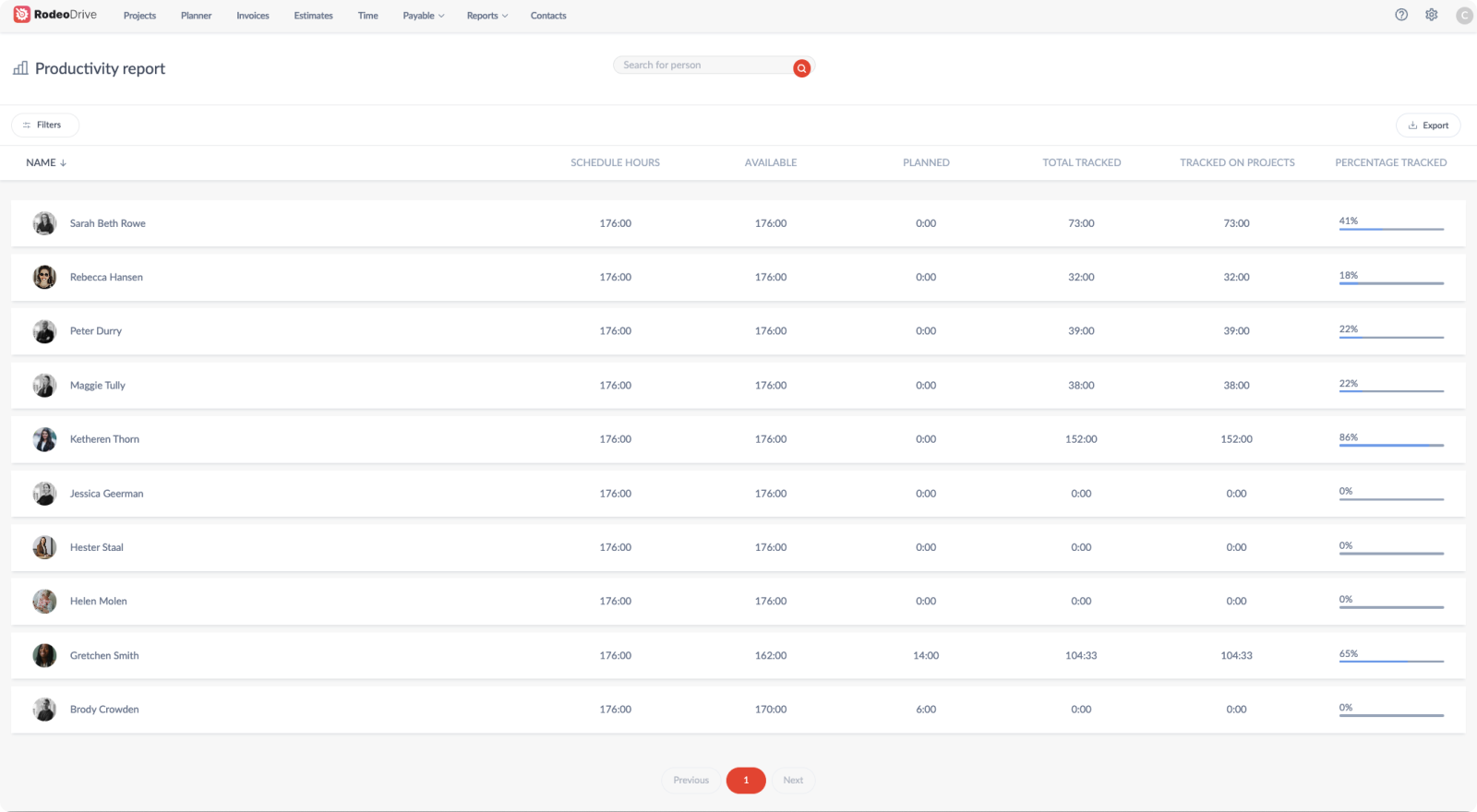

Rodeo Drive’s all-in-one nature is especially beneficial when it comes to reporting, as your project data is organized within your "Reports" tab, giving you insights into your project spending, time registration, and employee productivity. Plus, you’re able to export this data as a CSV or Excel file.

Also read: 6 Ways To Leverage Data with Real-Time Reporting

Financial information can be sensitive, and Rodeo Drive allows you to choose what information your team has access to. The same goes for guest users.

Rodeo Drive can also make it easy to stick with the budgeting technique you’re already using. For example, analogous budgeting involves reusing frameworks from previous projects, which Rodeo Drive excels at by allowing users to copy their entire budget from past projects. Just imagine how much time this feature could save you.

Come see Rodeo Drive for yourself and try it for free today.