Bottom-Up vs. Top-Down Budgeting: A Complete Comparison

Whether you're planning a large-scale endeavor or a small project, project budgeting can be intimidating and time-consuming. Understanding two of the most popular budgeting approaches — top-down and bottom-up — is essential to creating an effective budget and executing a successful project plan.

In this article, we'll explore the key differences between top-down and bottom-up project budgeting, discuss when to use each method, and help you understand which budgeting process is right for your needs.

What is top-down budgeting?

Top-down budgeting is an approach to financial planning where a company's senior management estimates the budget and allocates resources at a higher level. This type of budgeting is generally more focused on the big picture and less concerned with the details of individual departmental budgets.

In this method, the management team sets out the company's overall financial goals and objectives and then allocates the available funds to different departments and projects accordingly.

What is bottom-up budgeting?

As you’ve probably guessed, bottom-up budgeting is the opposite approach of top-down budgeting. In this method, each department or team within the company creates its budget based on its area of responsibility's specific needs and requirements.

These individual budgets are then consolidated and reviewed by higher management, who may make adjustments and optimizations as needed. Bottom-up budgeting is typically more time-consuming than top-down budgeting since it incorporates specific resource requirements.

What’s the difference between top-down and bottom-up budgeting?

From a project perspective, sometimes you aren’t given much choice with regard to your budgeting approach. Sometimes, the client will give you a set budget number to stick to, while other times the project manager has more flexibility to create a budget estimate based on project requirements.

This is why it’s important to understand how a bottom-up process differs from a top-down budgeting process. There are a few key differences to keep in mind:

- Budget creation process: Top-down budgeting starts at a higher level, with the project manager or client setting a certain amount that can be allocated toward project activities. On the other hand, bottom-up budgeting relies on team members’ financial forecasts to dictate what the budget should be.

- Employee involvement: Bottom-up budgeting empowers employees by involving them in significant financial decisions, while top-down budgeting is centered on management or client decision-making.

- Accuracy: Bottom-up budgeting typically involves more accurate forecasts and resource allocation due to the detailed understanding of specific project requirements, while top-down budgeting may overlook the needs of certain project pieces.

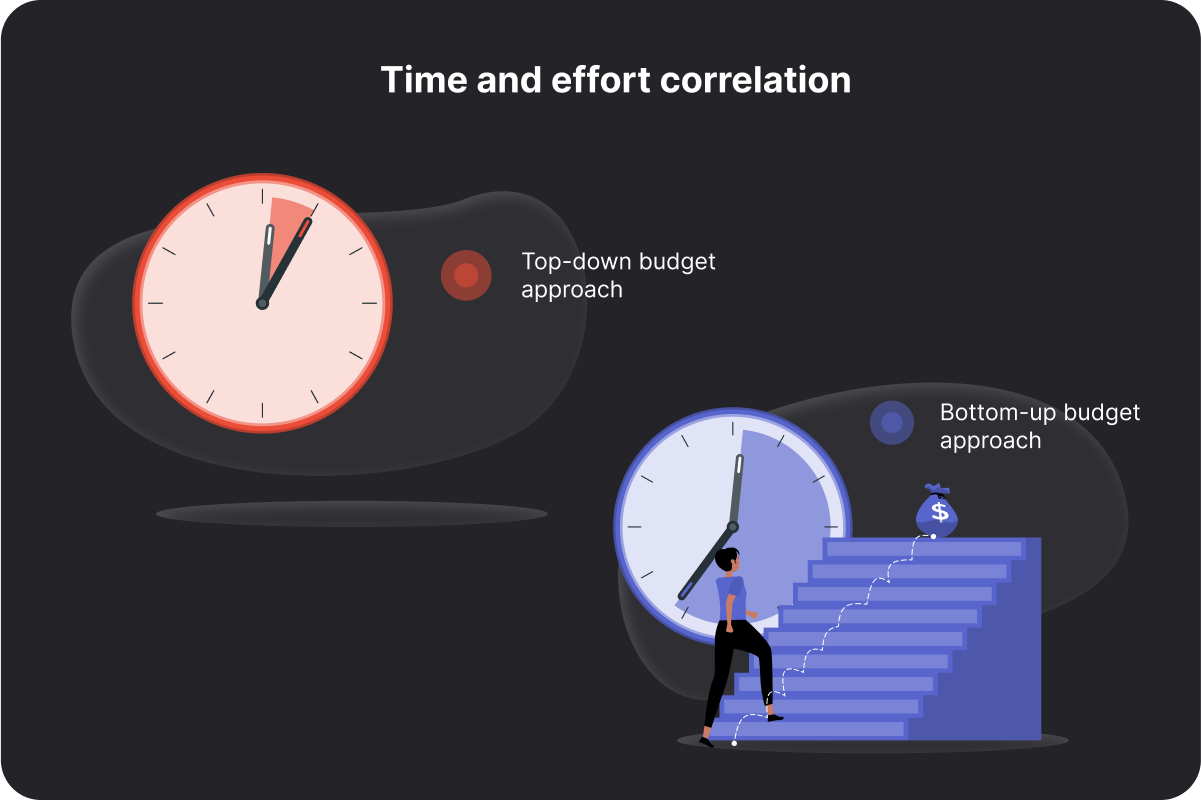

- Time and effort: The top-down approach takes less time and effort to implement, while the bottom-up process can be more involved and time-consuming.

Both top-down and bottom-up project budgeting have their own strengths and weaknesses. Top-down budgeting provides an overall perspective on the organization or project’s financial capabilities and allows for efficient decision-making. However, top-down budgets don’t always take all project costs into account, sometimes making them difficult to stick to.

On the other hand, bottom-up project budgeting allows for a detailed analysis of individual project costs, leading to more accurate forecasting and better control of project budgets. However, this method can be time-consuming and may not provide sufficient visibility into the organization's overall financial health. A successful project budgeting approach ultimately depends on the specific needs and goals of the organization.

Overall, both top-down and bottom-up methods have their own unique advantages for projects. The choice between these two budgeting approaches depends on the specific characteristics and requirements of the organization and its projects.

Related: 10 Proven Tips to Improve Your Project Cost Tracking Process

Understanding the top-down project budgeting process

Top-down budgeting involves the creation of a budget by upper management, which is then allocated to different department budgets. It is a hierarchical approach where executives dictate the budget, and it is up to lower-level department managers to ensure that it is adhered to. This approach is often used in large organizations or when there is a need for centralized control. In project management, this is when the budget is set without factoring in the specific resources needed for each project phase.

Top-down budgeting usually involves a few key steps:

- Establish budget goals and targets: In the first step of the top-down process, upper management sets the overall budget goals and targets for the organization. This could include revenue, profit, or cost reduction targets the company wants to achieve in the next financial year. For a project, a client might land on this number based on the resources set aside for this project initiative.

- Develop a budget outline: Senior management then creates a preliminary budget outline, which will include a high-level breakdown of how the total budget will be allocated to different departments or projects based on priority. In a project context, the project manager might outline the portion of funds dedicated to each project phase.

- Allocate funds: Once the budget outline is approved, senior management will allocate the funds to individual departments or projects. This will involve a detailed evaluation of each department or project's requirements and competing demands. The same goes for a project manager working on a singular project.

- Monitor budget performance: After allocating funds, senior management (or the project manager) will closely monitor the budget performance and ensure that each department or project meets its targets. Any issues or deviations from the budget outline will be addressed promptly.

- Evaluate and adjust budget: Finally, at the end of the financial year, senior management will evaluate the budget's overall performance and make adjustments for the next year. This will involve looking at actual results and comparing them with the original budget targets. Project-based work will follow the same process, which will inform future project plans.

The top-down budgeting process allows organizations to create an overall budget based on their intended goals and targets, then allocate funds to individual departments or projects. Ongoing evaluation will ensure that performance is monitored and the right adjustments are made. You might also want to consider setting aside a small contingency budget in case anything goes wrong.

What is an example of top-down budgeting?

In top-down budgeting, a client might give a project manager a total budget of $150,000 to execute the project objectives. From there, the project manager decides how to best divide the budget among the various project stages and activities.

This approach can help prevent overspending, as the project manager has an upfront sense of what project activities can be completed within the given budget. At the same time though, it’s less likely that a top-down approach will yield an accurate budget since it doesn’t take the cost of specific project activities into account.

Pros and cons of top-down budgeting

There are a few pros and cons to consider before implementing top-down budgeting as a budget allocation method.

Pros

- Achievement-driven: This approach places a strong emphasis on achieving business-wide strategic objectives and aligning financial resources with those objectives. This can be helpful in ensuring that expenses are tightly controlled and that spending is directed where it will have the most significant impact.

- Simplicity and efficiency: With a clear structure, the department managers or finance department can create their budgets more quickly and with fewer potential disputes over resource allocation. This can also lead to increased accountability, as tracking departmental or project spending against predefined targets is easier.

Related: 8 Steps to Track Project Budgets (and Maximize Profits)

Cons

- Overly rigid: Teams may feel constrained by their budgets, hindering creativity and potentially limiting growth opportunities. Additionally, top-down budgets can sometimes be perceived as out of touch with the realities of day-to-day team operations, leading to tension or dissatisfaction.

- Overlooks lower-level expertise: Top-down budgeting may not fully take into account the expertise and knowledge of lower-level employees. Team members who are closer to the work being done might have valuable insights into how resources should be allocated, but this may not be reflected in a top-down budget set by senior management or a project client.

When to use top-down budgeting

Top-down budgeting can be an effective approach for organizations with clear strategic objectives and a well-defined hierarchical structure. It may be particularly suitable for large businesses, where strong central control can help ensure alignment across multiple departments and teams. Additionally, organizations facing significant financial challenges or needing careful cost control might benefit from the added discipline and oversight provided by top-down budgeting.

However, top-down budgeting might feel overly restrictive for projects where the goal is innovation and collaboration. In this case, a bottom-up approach will allow team members to have more input and contribute more effectively to a project's success.

Understanding the bottom-up project budgeting process

Bottom-up budgeting is a process in which budgeting starts from the lowest levels of the organization, such as individual departments, and works its way up. This approach involves gathering information and ideas from all levels of the organization or project team to create a budget that reflects all needs and priorities.

This process can be broken down into the following steps:

- Identify budget owners and inputs: Bottom-up budgeting starts with identifying the budget owners — the people or departments responsible for submitting input into the budget. Budget owners are expected to provide certain inputs, such as expected expenses and performance targets. In a project context, each team member has a unique role, and only they know what’s required to complete their portion of the project.

- Gather budget inputs: Budget owners submit their inputs based on the instructions and guidelines provided in this step. Each input should contain the details of the expected expenses and revenues of the department, along with any other relevant information, such as performance targets or potential challenges. These inputs will be consolidated to create a comprehensive budget proposal.

- Review and assess budget inputs: Once all budget inputs are collected, the next step is to review and assess them. The budget review team will analyze each input to ensure that it aligns with the organization or project’s strategic goals and is realistic in terms of costs and resources. The review team will also look for anomalies or inconsistencies.

- Create the final budget: In the final step, a comprehensive budget is created that incorporates all the inputs from the budget owners. The budget should reflect the organization or project's strategic goals while also being realistic and achievable. Once an organization-wide budget is finalized, it is presented to senior management for approval.

This process is a useful method for developing an inclusive budget that addresses everyone’s needs. By empowering employees to contribute their ideas and priorities, project budgets become more accurate and realistic. The bottom-up method promotes transparency, accountability, and collaboration, leading to better budget decisions and overall success.

What is an example of bottom-up budgeting?

Imagine a project with the objective of successfully launching a new product. Within your project team, you’ll have people in charge of graphic design, print, and digital ads, among other functions. Instead of having the project manager decide the overall budget for the project, the bottom-up method would involve asking the team members involved what budget they’ll need in order to complete their portion of the project.

Once all of the project pieces have been assigned a budget, the project manager consolidates all of the estimates and reviews them. They might compare the budget estimate to a previous project to ensure it’s reasonable before sending the proposal to the client.

Pros and cons of bottom-up budgeting

Bottom-up budgeting has its advantages and disadvantages, which should be considered before implementing this approach in an organization.

Pros

- Increased accuracy: Since budgets are prepared by those who deal with the day-to-day operations and have a deep understanding of their needs, they are more accurate than top-down budgets that may overlook or misunderstand certain aspects.

- Employee empowerment: Giving responsibility to employees makes them feel more involved in the significant financial decisions of the organization. This encourages them to be more careful in their estimations and fosters a sense of ownership over their department or project’s success.

- Better resource allocation: By allowing team members to request the resources they feel they need, bottom-up budgeting can help ensure that resources are allocated based on actual demand and not derived from past budgets or assumptions.

Cons

- Time-consuming: Since each department must individually develop a budget, more time is required to create and review the budgets compared to top-down approaches.

- Difficulty aligning with organizational goals: The focus on individual department needs can sometimes result in budgets that do not align with the organization's broader financial goals and objectives, which may need to be resolved in further discussions or revisions.

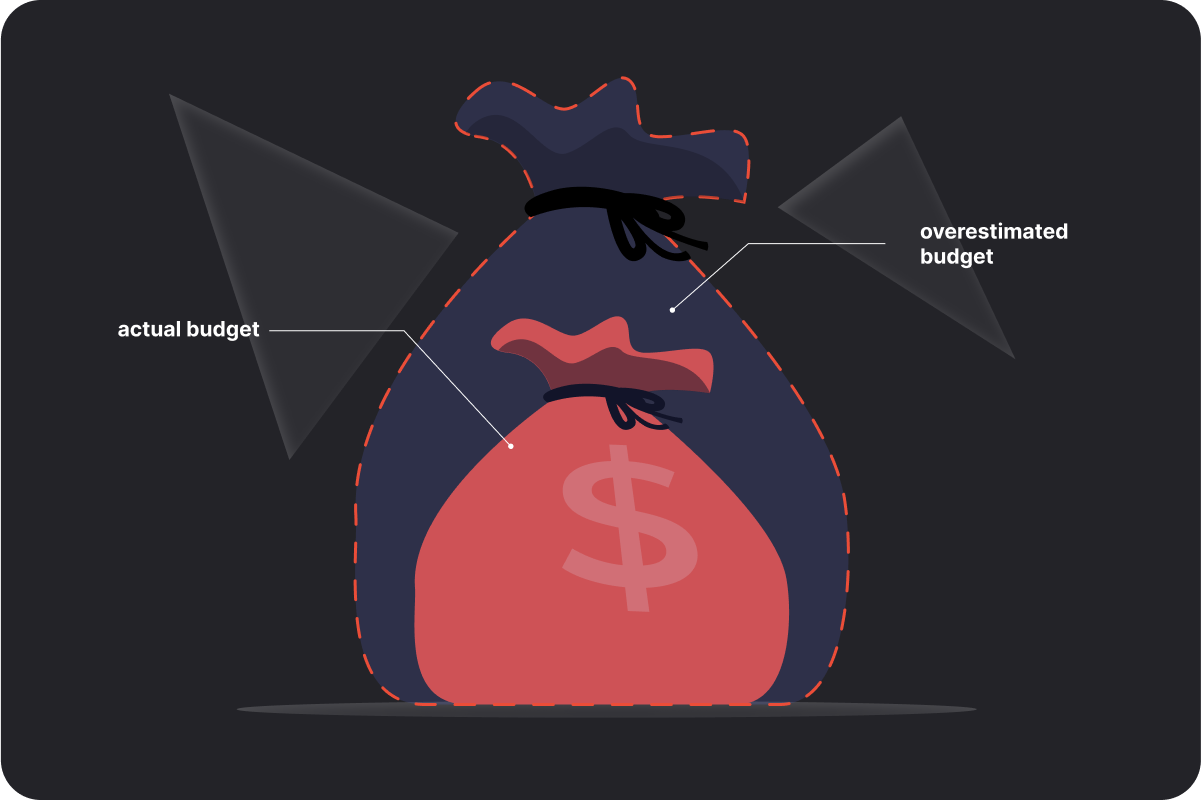

- Inflated budgets: As each department aims to secure enough resources, there is a possibility that they may overestimate their needs or present an inflated budget to ensure they receive their required funding.

When to use bottom-up budgeting

Implementing bottom-up budgeting is most effective in organizations where individual departments or teams autonomously operate and clearly understand their needs and priorities.

This might include organizations or projects that are highly specialized and subject to change. A bottom-up approach can help develop accurate and flexible budgets in response to an evolving project landscape.

Which budgeting process is right for you?

There's no one-size-fits-all solution when it comes to budgeting. Given that every individual, team, or business operates differently, finding a method that caters to your unique needs and objectives is essential. With a plethora of budgeting techniques available, this can be a daunting task. But don't worry, we can help you navigate through the options to identify the process that's best suited for you.

First, let's consider a more traditional method — incremental budgeting. This process involves analyzing the previous year's budget, identifying any crucial changes, and adjusting it accordingly for the coming year. Incremental budgeting works best for stable organizations with few variables to consider, or for a project that closely resembles a previously completed project.

However, it can also inhibit growth and development, as it typically focuses on maintaining the status quo, rather than pushing for innovation and improvement.

Rather than using the previous year’s budget, another option to consider is zero-based budgeting, which involves building a new budget from scratch each year (or before each project), requiring you to justify every expense in the process.

This can be a more time-consuming approach, but it encourages creative thinking and can result in cost-savings or innovative new ideas. Plus, as it focuses on understanding the true cost of each expenditure, it helps provide invaluable insights into areas that could potentially be trimmed back or reprioritized.

Regardless of which budgeting method you choose, you may find that you need some extra support. If streamlining your budgeting workflow is important for your business, see what a project budget management tool like Rodeo Drive can do for you.

Elevate your project budgeting processes with Rodeo Drive

Rodeo Drive is an all-in-one tool with the features you need to make managing projects effortless, including intuitive budget management. Our robust software can support your projects at every stage, meaning you can spend more time creating and less time on annoying administrative work.

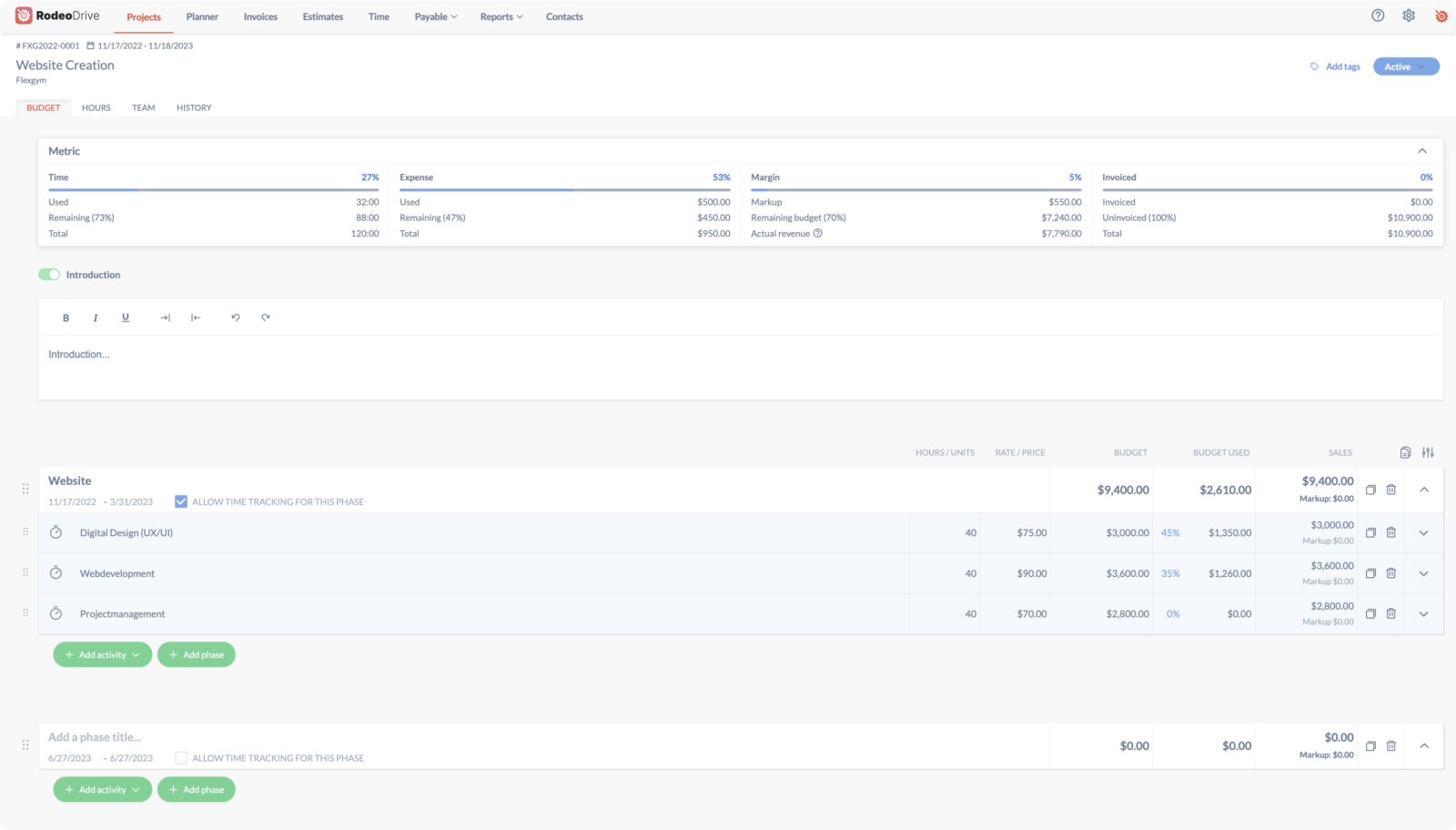

All projects begin with a budget in Rodeo Drive, as we believe this sets a strong foundation for project profitability. Rodeo Drive’s budgets are phase-based, meaning you’ll clearly see the expenses you expect to incur at every stage of the project.

Then, as your team records their time and project costs, your project budget will update in real-time to reflect your spending. If you’re overspending, this allows you to quickly course correctly.

Some of Rodeo Drive’s other stand-out features include:

- Plan and assign tasks to your team members with ease

- Track time spent on each project activity

- Create custom invoices and estimates and send them to clients directly from the Rodeo Drive

- Access a comprehensive set of reports on metrics like project profitability, employee productivity, time registration, and more

With all of the features you need to manage projects combined in one user-friendly tool, Rodeo Drive gives you a truly comprehensive strategic management solution. No need to invest in additional third-party software to make your team more productive and your projects more profitable.