Invoicing Clients: 11 Proven Tactics to Help You Get Paid

Getting paid isn't always as straightforward as sending an invoice. It requires careful planning, client relationships, effective communication, and a solid understanding of proven tactics to help you navigate the invoicing process smoothly.

Let's dive in and discover how you can improve your invoicing process and get paid faster.

When and how to invoice clients

Knowing when and how to invoice clients is crucial for maintaining a smooth and timely payment process. Here's a guide on when and how to invoice clients effectively:

- Determine your billing schedule: Establish a clear billing schedule or timeline with your client before starting any work or providing services. This schedule should outline when you will issue invoices and when payments are expected.

- Invoice promptly: Send invoices as soon as the work is completed, or according to the agreed-upon billing schedule. Prompt invoicing sets clear expectations and helps ensure timely payment.

- Be clear on payment terms: Clearly state the payment terms on your invoice, including the due date, accepted payment methods, and any late payment fees or discounts for early payment.

- Utilize professional invoices: Use professional templates or invoicing software to ensure consistency and professionalism in your invoicing process.

- Provide detailed descriptions: Include clear and comprehensive descriptions of the goods or services provided on your invoice. This helps clients understand the value they received and reduces the likelihood of payment disputes or delays.

- Send invoices electronically: Consider sending invoices electronically via email or using online invoicing platforms. Electronic invoices are more efficient and easier to track compared to traditional paper invoices.

11 tactics to invoice clients and get paid

Invoicing is the crucial link between the work you've done and the money you deserve, making it essential to have effective strategies in place to get paid promptly.

From setting clear payment terms to leveraging technology, these tactics will help you streamline your invoicing process, minimize late payments, and improve your cash flow.

Let's dive in and discover the proven tactics that enable you to invoice your clients effectively and get paid on time.

1. Be upfront with payment terms and fees

When you explicitly state your payment terms on your invoices, you establish clear expectations and ensure that your clients understand when and how payment is due. To simplify the payment process and minimize the risk of information getting lost or overlooked, it is crucial to send the invoice and payment terms together.

When it comes to invoicing clients for partial projects, such as requesting deposits or milestone payments, clear communication is key. It's essential to indicate the partial nature of the billing and provide transparency on the remaining amount to be paid and its due date.

Additionally, if the final payment is due as soon as the work is completed, this should be clearly stated as well.

2. Invest in client relationships

Treat each client as an individual and tailor your communication to their preferences. Take the time to understand their unique needs, respond to inquiries, and address any concerns they may have.

Maintain regular communication with your clients throughout the project. Regular check-ins allow you to provide updates, address any issues or concerns, and keep the client informed about the progress of their project.

Take the time to build a personal connection with your clients. Remember key details about their business or interests, inquire about their goals and challenges, and show genuine interest in their success.

Also read: 10 Tips for Writing Effective Project Management Emails

3. Offer various payment options

Offering multiple payment options is a smart strategy to facilitate smooth client transactions. While certain payment methods may be convenient for you, they might not be as favorable for your clients.

By providing various payment options such as bank transfers, credit cards, or online payments like PayPal, you can cater to their preferences and make the payment process more accessible and convenient. When you make it easy for clients to pay you, you remove potential barriers or friction in the payment process.

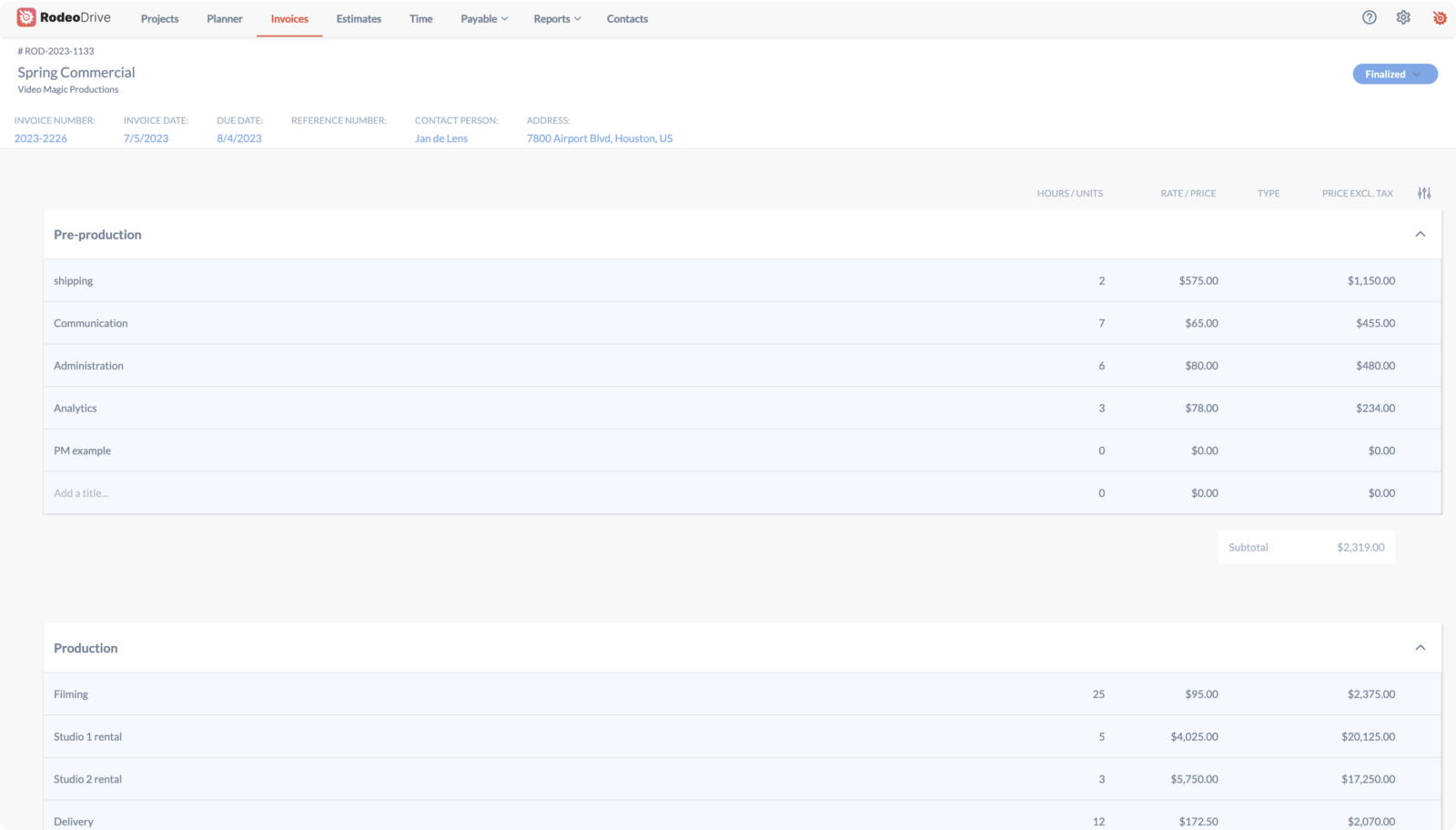

With all these different payment options, you want to ensure a seamless booking process for yourself. Rodeo Drive’s invoicing feature, for example, offers integration with QuickBooks (US) and Xero (UK) which helps you with bookkeeping and billing.

4. Invoice the right person

Your payment might be delayed if your invoice lands on the wrong desk. Invoicing the correct person or entity ensures accuracy in the billing process. It establishes accountability for payment and demonstrates your professionalism and attention to detail.

If you’re unsure who the invoice should be directed to, enquire with your point of contact during the project or call the financial department if it’s a larger company.

5. Create invoice templates

Spend some time thinking about what to include in your invoice. At a minimum, your client should know how much they should pay, what they’re for, and who they are paying.

Creating your invoices manually can reduce the time spent executing your project. Consider using project management invoicing software to create your invoice templates and keep them in one place for easy access.

Rodeo Drive uses the data from your logged hours to generate invoices, which means you don’t have to start from scratch or calculate the time spent on projects with a calculator. You can even split and send invoices in phases to benefit your cash flow.

6. Be prompt

Give your clients a good example here. The earlier you send out the invoice after the completed work, the better since you’re still top of mind at this stage. But you do want to be respectful here. Sending along the payment details together with your deliverables could confuse your clients about which document they need to open first.

7. Bill for work upfront

If your project is a large undertaking and will last months instead of weeks, consider billing upfront. Ask your clients if they’re willing to switch to a retainer contract and payment terms.

By issuing invoices at specific milestones or project phases, the payment is not solely dependent on the completion of all deliverables.

8. Offer early payment incentives

Offering early payment incentives can be an effective strategy to encourage your clients to settle their invoices promptly. Here's how you can offer early payment incentives:

- Common options include discounts on the total invoice amount, free additional services or products, extended warranties, or loyalty rewards.

- Clearly outline the terms of the early payment incentive. Specify the percentage of the discount or the specific reward clients will receive if they make the payment before the designated due date.

- Determine a reasonable timeframe for clients to qualify for the early payment incentive. This timeframe should allow them sufficient time to review the invoice, gather funds, and make the payment while still incentivizing prompt action.

- Show gratitude to clients who take advantage of the early payment incentive. Send a thank-you note or acknowledge their prompt payment in a personalized manner.

9. Monitor your accounts regularly

Ensuring you have a clear overview of your invoicing status is essential to stay organized and get paid on time. Numbering your invoices appropriately simplifies tracking and referencing. Assigning invoice numbers allows for easy identification, enabling you to record and monitor them efficiently.

If your contract specifies a payment deadline, setting reminders on your calendar can ensure timely follow-up. Another effective approach is to leverage bookkeeping tools that automate invoice tracking and payment reminders.

Once an invoice has been paid, updating your records accordingly is crucial to avoid any misunderstandings. You can streamline your invoicing process, maintain accurate financial records, and minimize the risk of overlooking payments by implementing proper tracking mechanisms and utilizing bookkeeping tools.

Related: 10 Proven Tips to Improve Your Project Cost Tracking Process

10. Know how to chase overdue payments

You can be patient with nonpaying clients but know when to act. If a payment deadline passes, send a polite follow-up reminder.

Assume good faith and approach the client with respect and understanding. Sometimes, unpaid invoices may be due to administrative oversights or other factors beyond their control.

Related: 10 Effective Ways to Handle Outstanding Invoices Like a Pro

11. Use intuitive invoicing software

There’s no more need to create and send invoices by hand these days. An intuitive invoicing software can streamline your work and get you from estimate to invoice in a few clicks. Look for a matching invoice system that gives you more time to dedicate to work and serve your clients.

By leveraging the hours recorded within Rodeo Drive for a specific project, you can easily generate invoices based on your tracked billable hours. These invoices can be customized with your branding, ensuring a professional touch.

Additionally, Rodeo Drive keeps you informed about the status of your invoices. It alerts you when invoices become overdue so you can stay on top of your bookkeeping processes.

Can I invoice a client without a signed contract?

Yes, it is possible to invoice a client without a signed contract, although it may not be ideal. Establishing written agreements with your clients is generally a best practice to ensure a clear understanding of expectations, deliverables, and payment terms.

If you have a verbal agreement with a client, you can still invoice them for the agreed-upon products or services. However, verbal agreements may be less enforceable and can lead to potential misunderstandings or disputes.

In some cases, a contractual relationship is formed through the actions and conduct of both parties. This can occur when both parties have an understanding of the terms and conditions, even if there is no formal agreement.

To mitigate the risk of overdue payments, it is recommended to have a written contract in place that outlines the terms and conditions of the agreement.

What if my work goes beyond the scope?

If your work goes beyond the initially agreed-upon scope and you need to invoice a client for additional services or work, it is important to address the situation professionally and transparently. Here are some steps to follow:

- Review the agreement: Review the existing contract or deal with the client. Determine if there are any provisions related to scope changes, additional work, or pricing adjustments. This will help you understand the contractual obligations and how to proceed.

- Communicate: Explain the situation honestly and clearly, highlighting the work that has gone beyond the original agreement. Clearly articulate the reasons for the scope change, such as unforeseen complexities or new requirements that emerged during the project.

- Discuss the impact: Provide a detailed breakdown of the additional work performed and explain how it aligns with the client's goals and objectives. Be prepared to address any concerns or questions the client may have.

- Propose a solution: Be transparent about the pricing methodology, whether it's an hourly rate, a fixed fee, or any other agreed-upon pricing structure. Provide a breakdown of the costs and explain how they were calculated.

By being transparent and offering fair and reasonable solutions, you can maintain a positive client relationship while ensuring you are appropriately compensated for the extra efforts expended.

Also read: Don't Let Scope Creep Ruin Your Project: Tips and Best Practices

When to take legal action

It shouldn’t come this far by using our proven tactics, but you never know. Deciding when to take legal action if you're not getting paid can be a significant step and should be considered carefully.

Before resorting to legal action, try other remedies to resolve the payment issue. This includes sending payment reminders or direct negotiations or mediation to reach a settlement.

Consider the potential impact on your business relationship with the client. Legal action may strain the relationship, making it difficult to work together in the future.

Also, carefully review the terms of your contract or agreement with the client. This will help determine the rights and remedies available to you and whether legal action is justified.

Then, gather all relevant documentation and evidence related to the payment issue. This may include invoices, contracts, communication records, proof of work, and any other relevant information. Strong documentation strengthens your case if legal action becomes necessary.

If you decide to take legal action, don’t do it on your own. Seek legal advice from an attorney who specializes in contract law or business disputes. They can guide your situation, assess your case's strengths, and advise on the appropriate course of action.

Use our invoice checklist

Ready to hit send? Double-check if all the relevant information is there and proofread one last time so you invoice clients professionally.

✔ Customer details

✔ Your company details and logo

✔ Date of issue

✔ Invoice ID or reference

✔ Scope and type of the delivered goods or services

✔ Pay, broken down according to tax rates and/or exemptions

✔ Payment terms (for example, pay upon receipt)

✔ Avoid complex language or jargon

✔ Get approval before sending if necessary

✔ File a copy for your bookkeeping records

Takeaway

Getting paid on time will support your cash flow and overall company goals. Project management requires wearing multiple hats, with invoicing being only a part of the job. It can be quite overwhelming to manage client relationships, the bookkeeping, and the invoicing process without the help of a software tool assisting you.

At Rodeo Drive, we believe that you should have all the features in one platform to ease the burden. Our invoicing, budgeting, time tracking, and reporting tools support project managers from the planning to the wrap-up phase.

Organize your invoices with Rodeo Drive. Sign up for free today.